Did you know that most Web3 projects rely heavily on DeFi launchpads to issue or launch new tokens, raise capital, and build early community trust? Well, if you don’t, now you do.

These platforms act as a bridge, connecting promising crypto startups with investors seeking the next opportunity in ICOs, IDOs, and IEOs.

Today, the demand for reliable and high-performing DeFi launchpads is higher than ever. With a growing pool of options, knowing where to commit your attention and funds matters. Each platform comes with unique features and investor benefits, from early token offerings to project vetting.

In this post, we’ll highlight the best DeFi launchpads to watch and use in 2025. These platforms stand out for their innovation, trust, community backing, and overall user experience.

Let’s get to it.

Read Also: Top DEX (Decentralized Exchange) Statistics for 2024

Key Takeaways

- DeFi launchpads connect crypto startups with early investors through decentralized, transparent token sales like IDOs, ICOs, and IEOs.

- Top platforms such as DAO Maker, Binance Launchpad, and Polkastarter offer unique features like tiered access, multi-chain support, and community-driven governance.

- Different launchpad types—IDO, ICO, IEO, INO, and multi-chain—cater to varied project needs and investor preferences.

- Launchpads provide early access to high-growth projects while ensuring safety through rigorous vetting, KYC compliance, and smart contract automation.

- Choosing the right launchpad enhances exposure, return potential, and community backing for both crypto projects and early adopters.

What Are DeFi Launchpads?

Source: Ideogram

DeFi launchpads are decentralized platforms that help blockchain and crypto projects raise funds by offering early access to their tokens through models like Initial DEX Offerings (IDOs), Initial Coin Offerings (ICOs), and Initial Exchange Offerings (IEOs).

These platforms connect crypto startups with interested investors before the tokens become publicly available on major exchanges.

Unlike traditional fundraising like the Initial public offerings (IPOs), DeFi launchpads operate without intermediaries. They use smart contracts to automate token sales, ensure transparency, and reduce the risk of fraud. Most also offer tiered access systems, where investors gain priority or allocation based on factors like token holdings or staking.

For both project teams and investors, DeFi launchpads provide a secure, efficient, and community-driven environment for token launches and early project support.

Top 11 ICO, IDO, and IEO Platforms for 2025

| Platform | Type | Key Features / Focus | Funds Raised (approx.) | Notable Chains Supported | Projects Launched | Special Highlights |

| DAO Maker | IDO | Strong Holder Offerings, tiered staking, multi-chain, compliance, decentralized governance | $90M+ | Ethereum, BNB Chain, others | 176 projects | Focus on retail investors, long-term holders, broad DeFi/NFT/GameFi support |

| Binance Launchpad | IEO | Rigorous vetting, huge user base, seamless Binance integration, direct token purchases | $199M+ | Binance Chain/Ecosystem | 107 projects | High-profile launches, instant credibility, large liquidity |

| Polkastarter | IDO | Multi-chain, 250 POLS token holding for access, advisory & marketing support | $48.5M+ | Ethereum, others | 108 projects | Retail-friendly, Coinbase-listed token, broad startup support |

| Bybit Launchpad | IEO | Lottery/subscription with BIT/USDT, KYC required, multi-chain support | $4.3B committed | Ethereum, BSC, Solana | 32 projects | Strong project growth (645% avg ROI), restricted countries |

| Seedify | IDO | Tiered staking with $SFUND, guaranteed allocations, refund policy, Viral Public Raise | $54M+ | BSC, Ethereum, Polygon | 125+ projects | GameFi, metaverse focus, refund for public IDOs |

| OKX Jumpstart | IEO | Curated projects, fair allocation, strong liquidity, multi-chain support | $55M+ | Ethereum, BSC, OKX Chain | 11 projects | High APRs, gaming & infrastructure focus |

| Gate.io Startup | IEO | 1000+ launches, KYC/AML, wide category support, large airdrops | $181M+ | Ethereum, BSC, others | 1026+ projects | Extensive launch history, strong compliance, diverse project types |

| GameFi Launchpad | IDO | Gaming/metaverse focus, tiered staking, multi-chain, 200K+ KYC users | $17.6M+ | BSC, Ethereum, Polygon, Solana | 100 projects | Highest ROI ~42.5x, simple participation process |

| PancakeSwap | IDO/IFO | Binance Smart Chain focus, yield farming, staking, lottery | $44M+ | BSC | 35+ projects | Low fees, direct DEX integration, user-friendly interface |

| Enjinstarter | IDO | Gaming/metaverse, $EJS staking, tiered rewards, strategic Web3 advisory | $21M+ | Ethereum, others | 106+ projects | ERC-1155 integration, Web2 to Web3 focus |

| Red Kite | IDO | Full project lifecycle support, refund policy, incubation, multi-chain | $15M+ | Ethereum, BSC (Polkadot upcoming) | 100+ projects | Highest ATH ROI +2700%, supports DeFi, AI, RWA, DePin |

DAO Maker

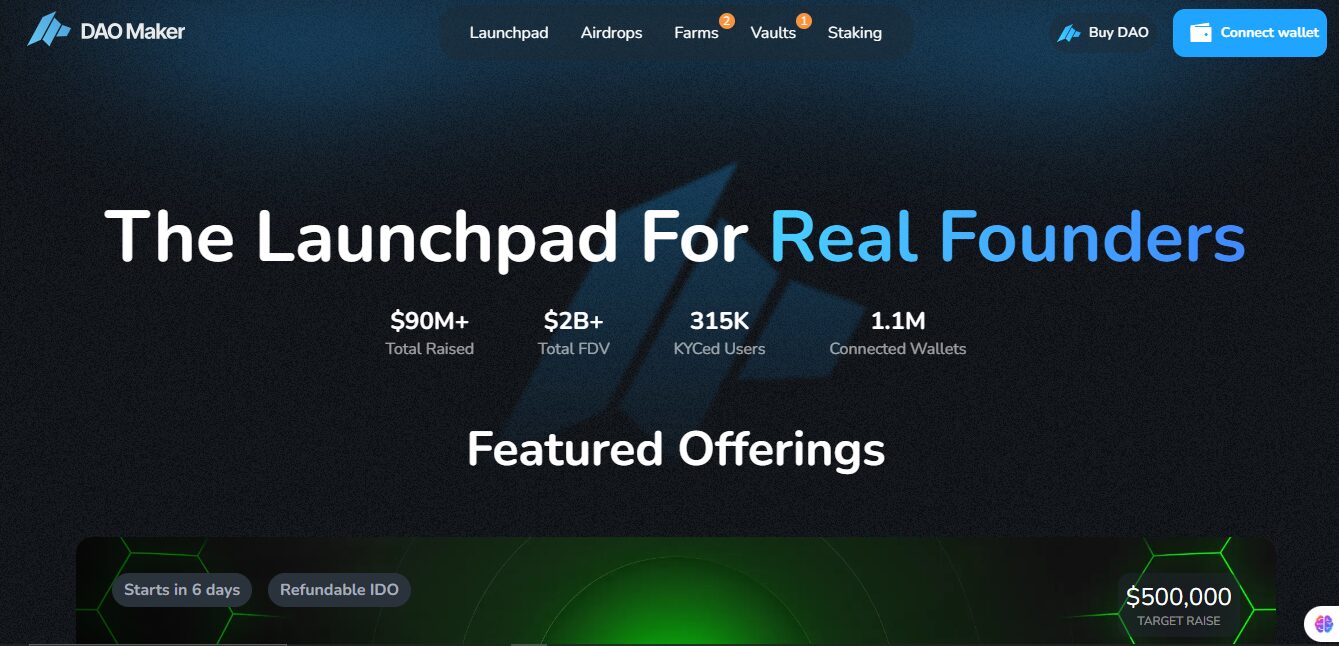

Focusing primarily on retail investors, DAO Maker has emerged as one of the leading DeFi launchpads, known for its secure and community-driven approach to token offerings. With over $90 million raised and a total FDV surpassing $2 billion, DAO Maker has facilitated funding for 176 projects, according to CryptoRank.

The platform supports Initial DEX Offerings (IDOs) and its signature Strong Holder Offerings (SHOs), which prioritize long-term token holders and committed community members. Startups launching on DAO Maker benefit from technical, financial, and marketing support, as well as tools for decentralized governance.

With 315,000+ KYCed users and over 1.1 million connected wallets, DAO Maker emphasizes compliance and reach. Its multi-chain capabilities, supporting Ethereum, BNB Chain, and others, enable flexibility and scalability—making it a preferred choice for DeFi, NFT, and GameFi projects seeking meaningful early backing.

Features

- A tiered staking system gives users fair access to new project allocations based on DAO token holdings.

- Strong Holder Offerings (SHOs) target committed token holders to ensure long-term project support.

- A rigorous vetting process evaluates project innovation, growth potential, and community alignment.

- Multi-chain compatibility enables seamless token launches across Ethereum, BNB Chain, and other networks.

- Community incentives reward participation and encourage user retention within project ecosystems.

- Integrated KYC ensures regulatory compliance while maintaining user trust and platform integrity.

- In-house tools support decentralized governance, giving communities a voice in project direction and decisions.

Binance Launchpad

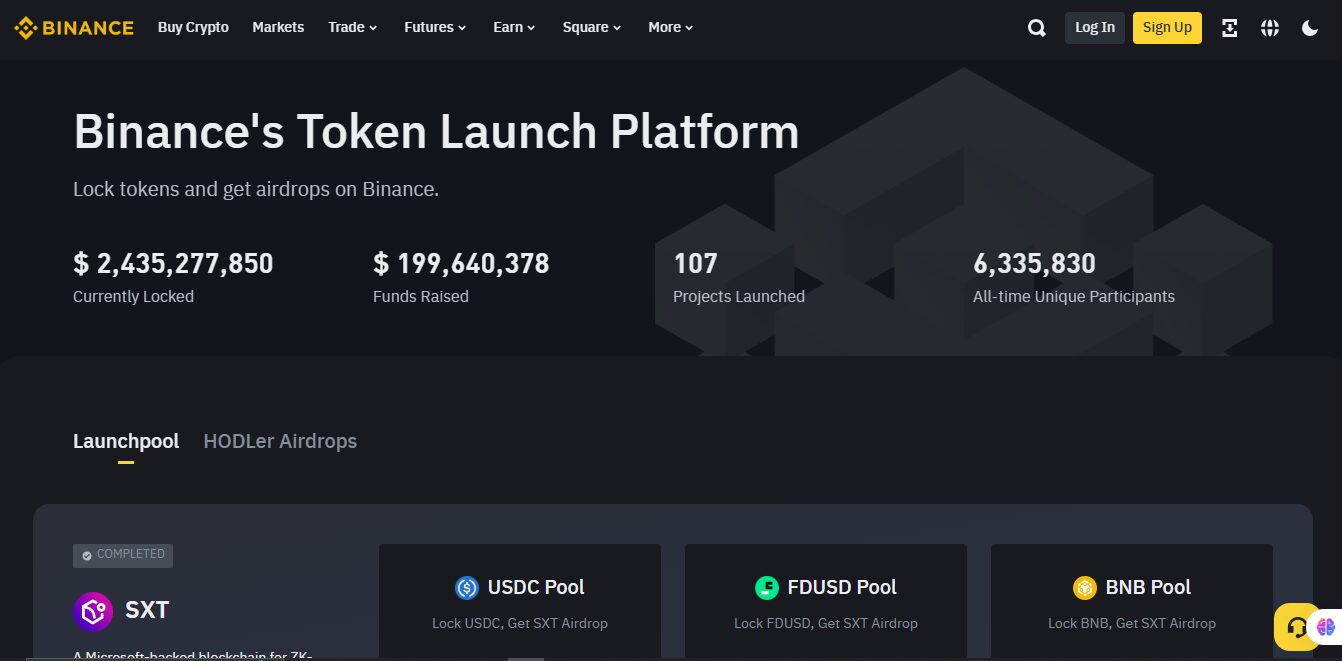

The Binance Launchpad is a leading DeFi launchpad that specializes in Initial Exchange Offerings (IEOs), providing early access to promising token projects through the trusted Binance ecosystem.

With over $199 million raised and 107 successful launches, it offers startups a secure path to market while giving users a direct way to participate in token sales.

By leveraging Binance’s infrastructure, projects gain instant credibility and exposure to over 6 million unique participants globally. Investors can lock tokens and receive airdrops, with more than $2.4 billion currently locked on the platform.

The platform’s rigorous vetting process ensures that only projects meeting Binance’s standards are featured, providing investors with early access to high-potential tokens. Notable successes include Axie Infinity (AXS), which achieved a 1,649x return from its launch price, and Polygon (MATIC), with returns up to 1,110x.

Unlike Binance Launchpool, which focuses on passive income through token staking, Binance Launchpad is all about early investment. It allows users to buy tokens directly before they hit the public market, offering higher potential returns and deeper project involvement.

Read Also: 9 Best Crypto Trading Strategies Every Trader Should Know

Features

- Offers early access to vetted token sales through Initial Exchange Offerings (IEOs).

- Provides direct exposure to millions of Binance users globally.

- Ensures high project credibility through Binance’s strict selection criteria.

- Integrates seamlessly with the Binance ecosystem for smooth token distribution.

- Enables transparent fundraising via secure smart contract mechanisms.

- Tracks detailed user participation metrics for every project.

- Supports post-launch project growth with marketing and advisory tools.

Polkastarter

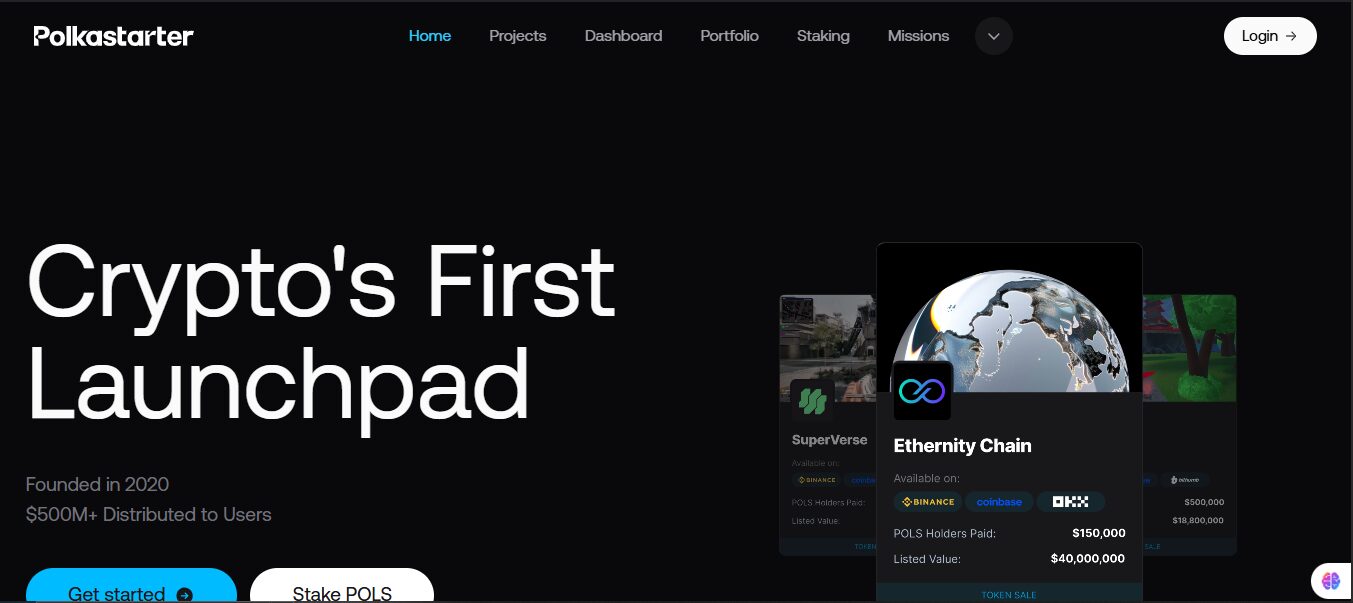

Launched in 2020, Polkastarter is a leading DeFi launchpad that has facilitated over 108 project launches, raising more than $48.5 million in capital from over 35,000 unique investors.

With an average raise of $472,000 per project and 49,559 on-chain holders, Polkastarter has established itself as a trusted gateway for early-stage crypto investments.

The platform supports a multi-chain approach, making it ideal for DeFi, NFT, gaming, and Metaverse projects seeking cross-chain exposure and community reach. Investors gain early access to vetted, high-quality projects by holding just 250 POLS tokens for seven days.

POLS, its native token, is one of the lowest-market-cap assets listed on Coinbase, Revolut, and Bitvavo. It is accessible to retail users in over 198 countries. Polkastarter also offers end-to-end startup support, from tokenomics and marketing to advisory and exchange listings.

Features

- Supports multi-chain fundraising, enabling projects to launch across different blockchain networks.

- Requires users to hold 250 POLS tokens for eligibility in IDO participation.

- Lists on major platforms like Coinbase, Revolut, and Bitvavo, increasing retail accessibility.

- Provides a rigorous project vetting process focused on innovation, feasibility, and community impact.

- Offers advisory, incubation, and strategic introductions to key industry players.

- Delivers full-scale marketing, branding, and go-to-market campaign support.

- Facilitates tokenomics design, including vesting schedules, staking, and liquidity strategies.

- Ensures follow-on capital support through introductions to funds and private investors.

Bybit Launchpad

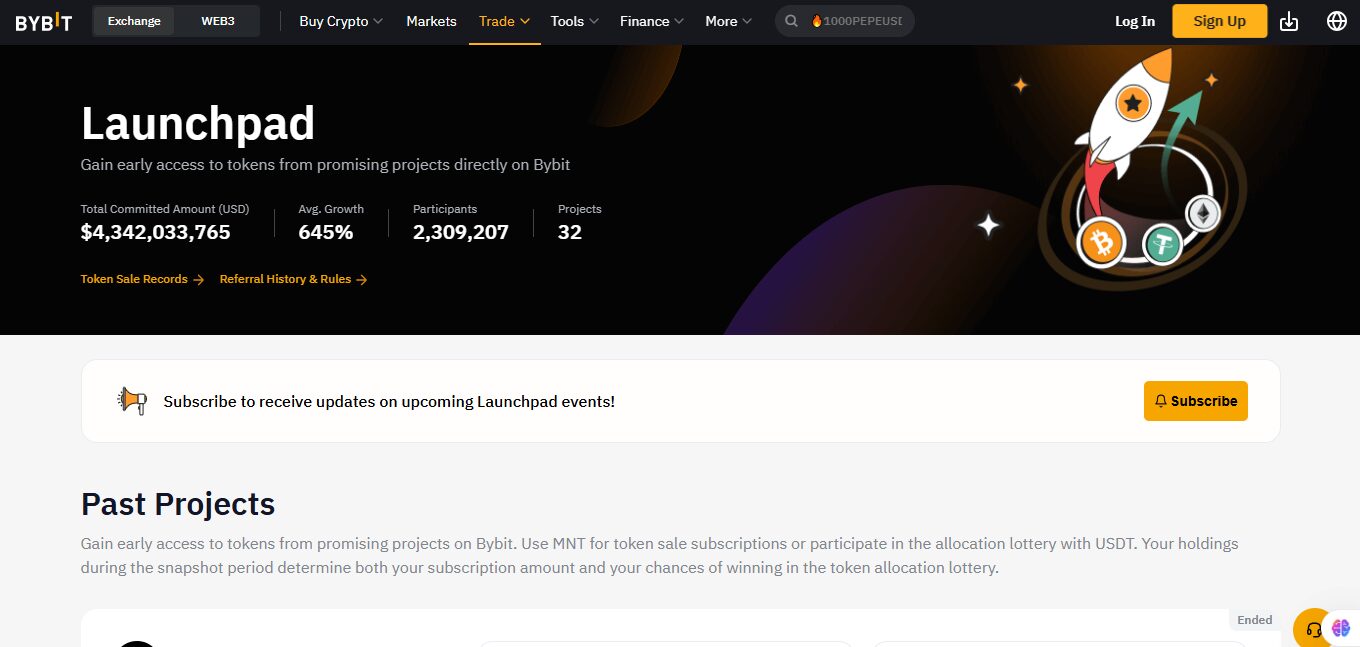

As the second IEO platform on the list, Bybit Launchpad is great for offering early token access through a secure and user-friendly interface. With over 2.3 million participants, 32 launched projects, and a total committed amount of $4.3 billion, it has become a go-to platform for users seeking exposure to Metaverse, DeFi, and gaming tokens.

Bybit’s average project growth is 645%, reflecting strong investor interest and project performance. Participants must complete Level 1 of Identity Verification or Business Verification to join token sales. Users can commit BIT tokens or USDT, with allocation chances determined by holdings during the snapshot period.

Supported chains include Ethereum, Binance Smart Chain, and Solana. However, services are restricted in several countries, including the U.S., U.K., and Canada, as outlined in Bybit’s service agreement.

Features

- Offers early access to tokens through subscription or lottery using BIT or USDT.

- Requires identity or business verification to participate in token sales.

- Supports multiple blockchains including Ethereum, BSC, and Solana.

- Uses a snapshot-based allocation system based on token holdings.

- Hosts high-growth projects with an average return of 645%.

- Provides access to trending categories like Metaverse, DeFi, and gaming.

Seedify

Seedify is one of the leading DeFi launchpads focused on GameFi, metaverse, NFT, and DeFi projects. According to CryptoRank, it has hosted over 125 IDOs and helped projects raise more than $54.36 million. Seedify uses a tier-based model where participants stake its native token, $SFUND, to gain access to token sales.

It supports Binance Smart Chain (BSC), Ethereum (ETH), and Polygon (MATIC), and has launched notable projects like Cryowar, ChainGuardians, and Bloktopia.

Seedify offers guaranteed allocations for higher-tier stakers and even provides a 7–14 day refund policy for public IDOs, boosting investor trust. Its Viral Public Raise Model adds lottery-based access for non-stakers, increasing reach and adoption.

With just 100 SFUND, users can enter tier 1, while higher tiers offer better allocation guarantees and participation benefits.

Features

- Uses a tier-based system where $SFUND holders gain access to IDOs based on token amounts staked.

- Offers guaranteed allocations for tier 2 and tier 3 participants.

- Supports leading blockchain networks like Binance Smart Chain, Ethereum, and Polygon.

- Implements a 7–14 day refund policy for public IDOs to enhance investor protection.

- Specializes in launching GameFi, metaverse, NFT, and DeFi projects.

- Introduces a Viral Public Raise Model to increase project visibility and token utility.

- Provides discounted token prices for $SFUND stakers during launches.

- Allocates IDO slots through random selection for tier 1 to ensure fairness.

- Includes a community polling system to shape tier benefits and participation rules.

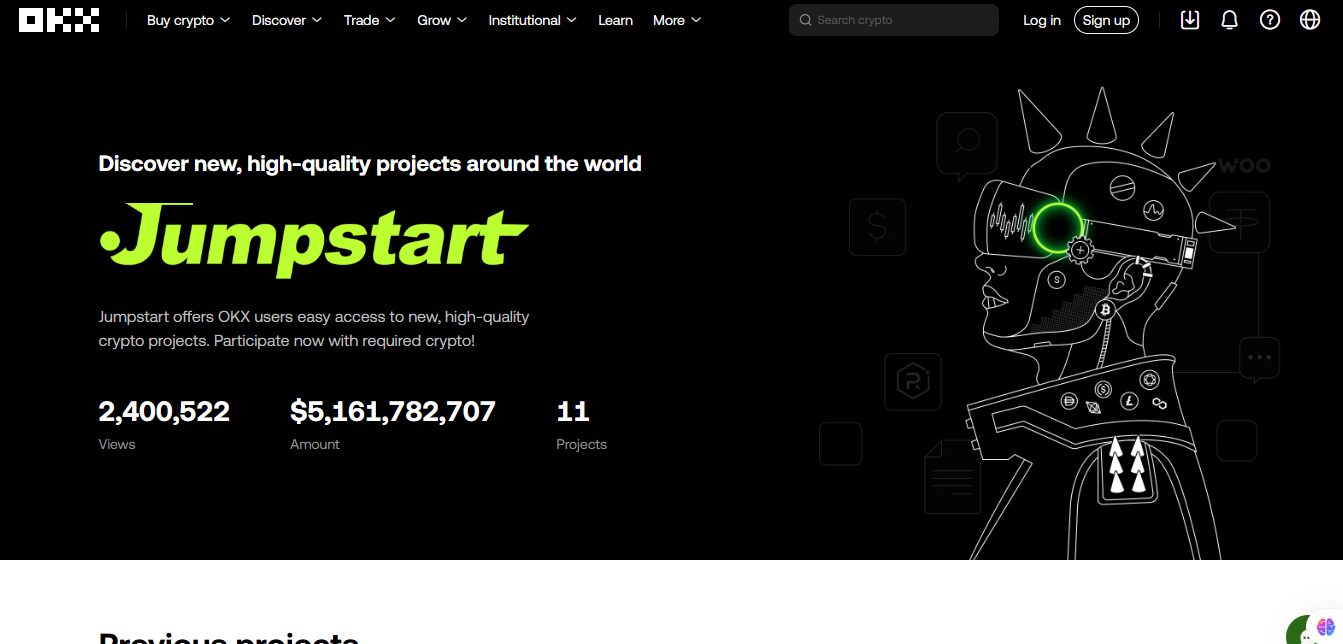

OKX Jumpstart

OKX Jumpstart is the official token launch platform by OKX, designed to support early-stage blockchain projects and give users early access to high-potential tokens.

Since its launch, OKX Jumpstart has raised over $55.29 million across 11 carefully curated projects, according to data from CryptoRank. Popular categories include DeFi, gaming, and infrastructure, with standout tokens like Animecoin (ANIME), Matr1x (MAX), and Ultiverse (ULTI), all offering significant rewards and historic APRs of up to +389%.

Projects on Jumpstart are backed by robust community engagement, high liquidity, and a commitment to fairness.

The platform supports major blockchains like Ethereum (ETH), Binance Smart Chain (BSC), and OKX Chain (OKC). With millions of global visits and strong exposure for listed tokens, OKX Jumpstart offers investors a transparent, reliable path into the world of early token offerings.

Features

- Offers early access to promising blockchain projects through secure token launches.

- Supports top chains including Ethereum, Binance Smart Chain, and OKX Chain.

- Provides high historical APRs with strong reward incentives for participants.

- Ensures fair participation through transparent allocation mechanisms.

- Features a curated selection of DeFi, gaming, and infrastructure projects.

- Delivers global exposure with millions of platform visits and strong community reach.

- Maintains deep liquidity to support token performance post-launch.

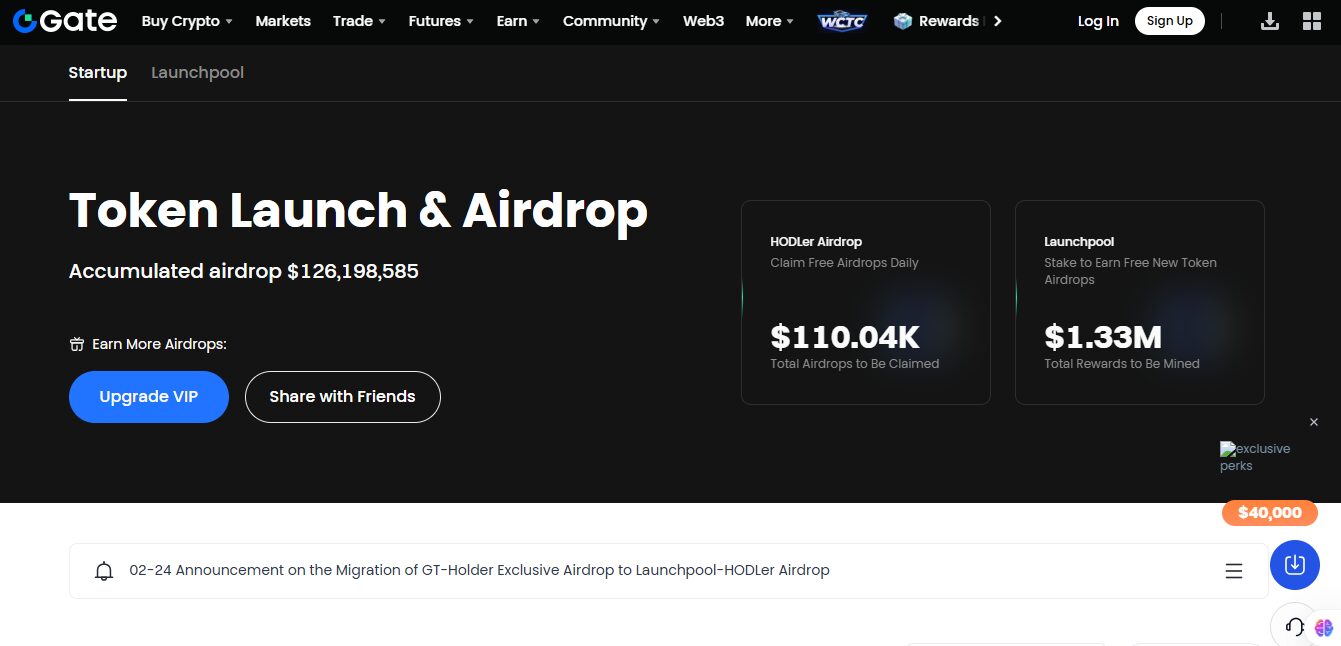

Gate.io Startup

Like other IEOs, Gate.io Startup offers a streamlined path for crypto projects to launch tokens and raise capital directly through a centralized exchange. With over 1,026 launches and a total of $181.03 million raised, it ranks among the most active IEO platforms, according to CryptoRank.

Gate.io Startup supports a wide range of project categories including NFTs, EVM-compatible applications, smart contracts, Play-to-Earn games, and mini apps, giving both developers and investors access to a diverse set of opportunities.

One interesting thing about Gate.io Startup is its robust infrastructure. It combines a user-friendly interface with strong compliance features, such as KYC and AML checks, ensuring a safe environment for participants.

With over $126 million in accumulated airdrops, the platform also incentivizes engagement while helping projects grow and gain visibility among a global crypto audience.

Features

- Offers seamless token launches through a centralized exchange interface.

- Supports a wide range of project types, including NFTs, EVM apps, and Play-to-Earn games.

- Implements strict KYC and AML compliance to ensure user security and regulatory alignment.

- Provides direct token purchases using Gate.io’s native token or other supported cryptocurrencies.

- Distributes substantial airdrops, with over $126 million awarded to participants.

- Delivers a user-friendly platform that simplifies participation in token sales for all investors.

GameFi

GameFi Launchpad is a leading platform tailored for blockchain-based gaming, play-to-earn (P2E), and metaverse projects. With 100 total launches and over $17.64 million raised, it stands out as a go-to destination for both developers and investors in the GameFi ecosystem.

The platform boasts an impressive ATH average ROI of 42.51x and supports a growing community of 200K+ KYC-verified users.

GameFi makes it simple to get started: users sign up, connect their wallet, stake $GAFI to unlock tier levels, complete KYC, and join IDOs by purchasing tokens and claiming them post-listing. Its focus on high-quality projects and innovative staking mechanics sets it apart.

GameFi supports multiple blockchains, including BSC, Ethereum, Polygon, and Solana, making it versatile and accessible. It’s especially known for hosting launches in categories like play-to-earn gaming, AI, and real-world assets (RWA).

Features

- Specializes in launching blockchain-based gaming and metaverse projects.

- Supports multi-chain integrations including BSC, Ethereum, Polygon, and Solana.

- Offers a tiered staking system using $GAFI to determine IDO allocation.

- Maintains a large community with over 200,000 KYC-verified users.

- Provides an average all-time high ROI of 42.51x across projects.

- Simplifies participation through a streamlined 4-step process for joining sales.

- Focuses on high-growth categories like play-to-earn games, AI, and real-world assets.

PancakeSwap

This is a leading decentralized exchange (DEX) on BNB Chain, supporting yield farming, staking, and token launches via Initial Farm Offerings (IFOs). With over 35 projects launched and $44.19M in total funds raised, it hosts diverse DeFi initiatives like Yield Farming, DAO, Bitcoin Scaling, and LSDfi.

PancakeSwap’s IFO process includes outreach, due diligence, marketing prep, AMAs, and post-launch support, ensuring seamless token launches. Known for its user-friendly interface and strong community engagement, PancakeSwap also features Syrup Pools, Farms, and a lottery system.

Backed by a robust ecosystem and cross-chain compatibility, PancakeSwap remains a cornerstone of decentralized finance, empowering projects and users alike.

Features

- Hosts token launches directly on Binance Smart Chain with low transaction fees.

- Provides access to Initial Farm Offerings (IFOs) through a simple staking mechanism.

- Requires users to commit CAKE tokens to participate in token sales.

- Offers transparent project vetting and community-driven launch processes.

- Integrates directly with PancakeSwap’s DEX for immediate post-launch token trading.

Enjinstarter

Enjinstarter is a next-generation DeFi launchpad designed to support blockchain, gaming, and metaverse-focused projects. Originating from Enjin, a pioneer in blockchain gaming and the creator of the ERC-1155 token standard, Enjinstarter provides a robust ecosystem for creators, developers, and Web2 brands transitioning into Web3.

The platform has successfully funded more than 50 IDOs, launched over 106 projects, raising more than $21.04 million, according to CryptoRank. It features a native token, $EJS, separate from Enjin’s primary cryptocurrency, $ENJ.

Users can stake and lock $EJS for access to token launches, tiered participation, and increased staking rewards—longer lock-up periods unlock greater incentives.

Enjinstarter also offers strategic services to help businesses build Web3-ready digital asset frameworks. With a strong community, proven fundraising success, and deep integration with the gaming sector, it remains a standout choice for innovative blockchain project launches in 2025.

Features

- Supports token launches for blockchain, gaming, and metaverse-focused projects.

- Offers a native utility token, $EJS, used for staking and tier-based participation.

- Provides strategic advisory for Web2 brands entering the Web3 space.

- Enables higher staking rewards through extended token lock-up periods.

- Integrates with the Enjin ecosystem, known for pioneering the ERC-1155 standard.

- Hosts a successful track record with over 106 project launches and $21.04M raised.

- Maintains a community-driven model that prioritizes transparency and accessibility.

Red Kite

With over 100 IDO projects launched and $15 million raised, Red Kite has established itself as a reliable and investor-focused DeFi launchpad. It boasts an impressive +2,701.3% ATH average ROI and a strong community of 200,000+ KYC-verified members.

Red Kite offers full-stack support for crypto projects—from incubation and marketing to token launch and post-launch growth.

The platform is open to all promising ideas, with a transparent tier system and refund policies. Investors benefit from structured vesting, early access through whitelisting, and cross-chain compatibility on Ethereum and Binance Smart Chain, with Polkadot support coming soon.

Red Kite doesn’t just launch tokens; it helps projects scale with tailored trading strategies, deep community backing, and loyal alpha users.

Its incubation program covers DeFi, AI, RWA, and DePin sectors, ensuring relevance and growth across verticals. As an OG in the space, Red Kite continues to lead with innovation, trust, and proven performance.

Features

- Supports IDO launches on multiple chains including Ethereum and Binance Smart Chain.

- Offers full lifecycle support from project idea to post-launch growth.

- Maintains a community of over 200,000 KYC-verified members for secure participation.

- Features a structured tier system for fair token allocation and investment access.

- Provides customizable marketing and listing strategies for project visibility.

- Enables a 24-hour refund policy for added investor confidence.

- Delivers incubation and acceleration programs tailored to DeFi, AI, RWA, and DePin sectors.

- Plans expansion to Polkadot with flexible pool types and whitelist conditions.

Different Types of DeFi Launchpads?

DeFi launchpads vary based on their fundraising models and platforms they operate on. Understanding the different types can help investors and project teams choose the most suitable option for their goals.

Here are the main types of DeFi launchpads, each with its unique approach:

IDO Launchpads (Initial DEX Offering)

IDO launchpads allow projects to launch their tokens directly on a decentralized exchange (DEX). These platforms use smart contracts to manage token sales, ensuring transparency and automation. Investors swap stablecoins or native tokens (like ETH or BNB) for the project’s token.

Key features include:

- No intermediaries

- Instant liquidity through DEX listings

- Typically faster and more community-driven

Popular examples: Red Kite, DAO Maker, Seedify, GameFi

ICO Launchpads (Initial Coin Offering)

ICO launchpads are more centralized compared to IDOs. They allow projects to raise funds directly from investors without necessarily listing on an exchange immediately. These platforms were among the earliest forms of token sales.

Key features are:

- Direct token purchase via platform or project website

- Often includes investor whitelist and KYC requirements

- Less focus on instant DEX listing

Popular examples: CoinList, TokenSoft

IEO Launchpads (Initial Exchange Offering)

IEO launchpads operate through centralized exchanges (CEX). The exchange acts as a middleman, conducting the token sale and offering credibility by vetting the project.

Key features include:

- Hosted by exchanges like Binance or KuCoin

- Higher investor trust due to project vetting

- Tokens are listed on the exchange after the sale

Popular examples: Binance Launchpad, Gate.io Startup, OKX Jumpstart

INO Launchpads (Initial NFT Offering)

INO launchpads are used by NFT-based projects to raise capital by offering early access to non-fungible tokens (NFTs). These tokens may represent game assets, digital art, or membership perks.

Key features:

- Focused on NFT sales

- Often linked with GameFi or Metaverse projects

- Investors receive NFTs instead of fungible tokens

Popular examples: Seedify NFT Launchpad

Multi-chain Launchpads

These platforms support token launches across multiple blockchains, such as Ethereum, Binance Smart Chain, Solana, or Polkadot. They offer flexibility for developers and a broader reach for investors.

Key features are:

- One platform, multiple chain options

- Cross-chain token deployment and vesting

- Broader exposure and market access

Popular example: Polkastarter

Why You Should Use a Crypto Launchpad

Using a crypto launchpad offers strategic advantages for both investors and project founders. These platforms simplify and secure the process of participating in token sales, offering curated access to high-potential crypto projects.

Early Access to Promising Projects

Launchpads allow users to invest in projects before tokens hit the open market. This early entry often means lower prices and higher potential returns once the token is listed.

Vetted Opportunities

Most launchpads screen and audit projects before listing them. This added layer of due diligence helps reduce the risk of scams and poorly structured startups.

Fair and Transparent Allocation

Launchpads often use tiered systems or lottery models to distribute tokens fairly among participants, ensuring transparent participation and reducing the impact of bots or whales.

Community and Ecosystem Growth

Participating in launchpads helps investors support ecosystems they believe in, while projects benefit from early community backing, liquidity, and real-time feedback.

How To Choose A DeFi Launchpad for Your Project

Choosing the right DeFi launchpad can significantly impact the success of your token launch. Each platform offers different strengths, and selecting the one that aligns with your project’s goals is key to building traction, trust, and long-term value.

Check the Launchpad’s Reputation and Track Record

Start with platforms that have successfully launched multiple projects and maintained high average returns. Look into past IDOs, user feedback, and how well previous tokens performed after launch.

Understand Platform Requirements

Each launchpad has its own eligibility standards. Some require technical audits, KYC, or MVPs, while others are more flexible. Ensure your project meets all criteria before applying.

Look for Ecosystem Fit

Choose a launchpad that supports your blockchain (e.g., Ethereum, BSC, Polkadot) and has a community aligned with your niche—be it DeFi, GameFi, AI, or NFTs.

Evaluate Marketing and Post-Launch Support

The best launchpads don’t just host token sales—they offer marketing, advisory, liquidity strategy, and community-building services. These extras can be vital for sustainable growth.

Consider Tokenomics and Fundraising Flexibility

Choose a platform that lets you customize vesting schedules, refund policies, and fundraising targets. Transparent and flexible models build trust with early investors.

In short, the right DeFi launchpad isn’t just a launch site—it’s a long-term partner. Make your choice based on strategic alignment, not just hype.

Final Thoughts

You’ve come to the end of your search for the best DeFi launchpads in 2025—and you’re now equipped with the insight to choose wisely. From early token access to community-backed support, each platform we covered offers real value for crypto founders and investors alike.

As more projects look to raise smart, secure capital, launchpads will continue to shape how Web3 grows.

Stay informed, research deeply, and choose the platform that aligns with your vision—because timing and the right partner make all the difference.

Frequently Asked Questions

Which Is the Best DeFi Project?

There’s no single “best” DeFi project, but DAO Maker, Binance Launchpad, and Polkastarter are among the top choices for 2025 due to their strong track records, security, and community support.

Are Crypto Launchpads Worth It?

Yes, crypto launchpads are worth it for early access to vetted projects, potential high returns, and reduced investment risks—if you choose reputable platforms and understand the risks involved.

What Are the Top 3 DeFi Coins?

The top 3 DeFi coins are Uniswap (UNI), Aave (AAVE), and Maker (MKR), known for their leading roles in decentralized exchanges, lending protocols, and stablecoin governance.

What Is the Best Crypto Exchange for Launchpad?

The best crypto exchange for launchpads is Binance Launchpad, known for its large user base, strong vetting process, and seamless integration within the Binance ecosystem, offering high credibility and exposure for token launches.