What if you could trade cryptocurrency directly with someone halfway across the world, without a bank or an exchange, just you and them? That’s exactly what a P2P crypto exchange allows.

These platforms connect buyers and sellers directly, cutting out third-party control and giving users more freedom over how they trade.

Even if you’re looking to pay with local currency, avoid high fees, or keep your transactions more private, P2P exchanges offer a flexible way to do it.

In this article, we’ll break down how P2P crypto exchanges work, why they’re important, the risks involved, popular P2Pcrypto exchanges, and how you can trade safely and confidently.

Key Takeaways

- P2P crypto exchanges let people trade crypto directly with each other without using middlemen.

- P2P trading gives you more privacy, lower fees, and a wide range of payment methods.

- Popular P2P platforms include Binance P2P, OKX P2P, Paxful, and many more.

- Most P2P exchanges require account setup and may ask for ID verification (KYC).

- Using tools like user ratings, dispute systems, and 2FA helps keep trades secure.

What is a P2P Crypto Exchange?

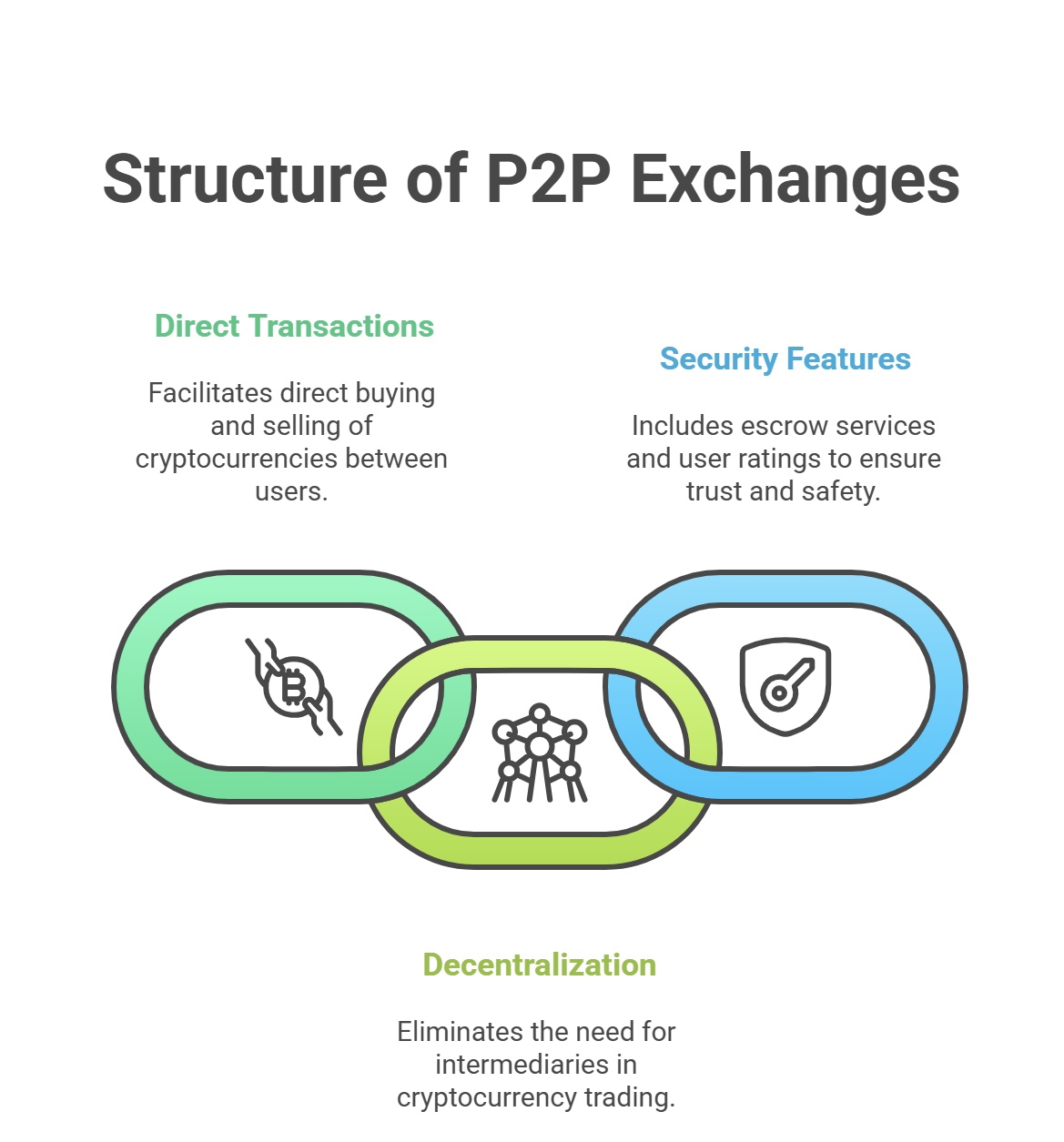

A peer-to-peer (P2P) crypto exchange is a platform that enables individuals to buy and sell cryptocurrencies directly with each other, without the involvement of a centralized intermediary.

These exchanges facilitate direct transactions between users by providing a digital marketplace where buyers and sellers can post offers, negotiate terms, and execute trades.

Key Components of P2P Exchanges

Below are the important elements that constitute a P2P crypto exchange:

1. Order Book and Trade Listings

The order book is a central feature of P2P exchanges, displaying active buy and sell offers posted by users.

Each listing typically includes details such as the cryptocurrency type, trade amount, price, preferred payment method, and any specific terms set by the trader.

This transparency allows users to browse available offers and select trades that align with their preferences.

For instance, platforms like Binance P2P and OKX P2P provide comprehensive order books that facilitate easy navigation and selection of suitable trading partners.

2. Escrow Services

Escrow services are integral to P2P exchanges, providing a layer of security by holding the seller’s cryptocurrency during the transaction process. When a trade is initiated, the platform locks the crypto in escrow until the buyer confirms payment.

Once the seller verifies receipt of funds, the cryptocurrency is released to the buyer. This mechanism protects both parties from potential fraud.

Binance P2P, for example, employs an escrow system to safeguard transactions, ensuring that neither party can default without consequences.

3. Identity Verification and KYC

While P2P exchanges prioritize user privacy, many implement Know Your Customer (KYC) protocols to enhance security and comply with regulatory standards.

Users may be required to submit identification documents to verify their identity, which helps in building trust among traders and deterring malicious activities.

Some platforms, like LocalCoinSwap, offer optional KYC, allowing users to choose their level of anonymity based on their comfort and the platform’s requirements.

4. Dispute Resolution Mechanisms

Disputes can arise during P2P transactions due to misunderstandings or fraudulent behavior. To address this, P2P exchanges provide dispute resolution systems where users can report issues.

The platform’s support team then investigates the matter, reviewing evidence from both parties to reach a fair resolution. This process ensures that users have recourse in case of disagreements, maintaining the integrity of the trading environment.

5. Supported Payment Methods

P2P exchanges offer a variety of payment options to accommodate users from different regions and with varying preferences.

These can include bank transfers, mobile money, digital wallets, and even cash payments.

For example, Paxful supports over 350 payment methods, enabling users worldwide to engage in crypto trading using familiar and accessible channels.

6. Transaction Fees and Fee Structures

P2P exchanges may charge fees for facilitating trades, though these are often lower than those on centralized platforms.

Fees can vary based on the platform’s policies, the user’s role (buyer or seller), and the specific services used.

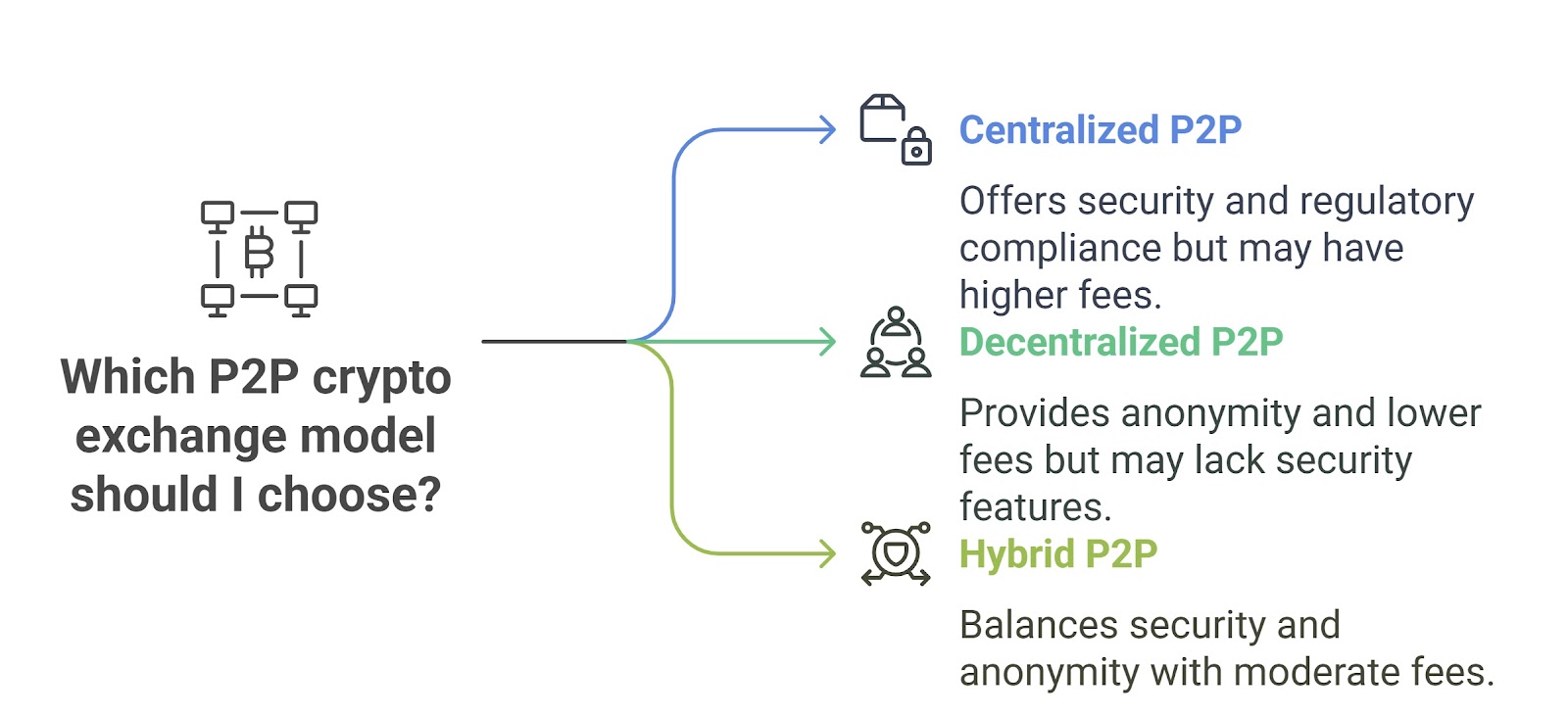

Types of P2P Crypto Exchange Models

Peer-to-peer (P2P) crypto exchanges facilitate direct transactions between users without intermediaries.

These platforms can be categorized into three primary models: decentralized, centralized, and hybrid.

1. Decentralized P2P Exchanges

Decentralized P2P exchanges allow users to trade cryptocurrencies directly without involving a central authority. Trades are executed through smart contracts or multisig wallets, ensuring that users keep full control of their funds.

These platforms are known for strong privacy and security, as they often don’t require KYC or registration. However, they can be less intuitive for beginners and may have lower liquidity compared to centralized options.

A strong example is Bisq, a desktop-based exchange that operates entirely over the Tor network. It offers no account sign-ups, uses 2-of-3 multisig escrow, and stores all user data locally, making it a solid choice for privacy-focused traders.

2. Centralized P2P Exchanges

Centralized P2P exchanges are run by companies that connect buyers and sellers through their platform.

These exchanges offer user-friendly interfaces, high liquidity, and built-in tools like escrow protection, dispute resolution, and user verification systems. However, you must trust the platform with your data and sometimes even their crypto funds.

A well-known example is Binance P2P, which supports hundreds of payment methods and operates in multiple countries. It provides strong security features such as two-factor authentication, trusted merchant programs, and a visible feedback system that helps reduce fraud.

3. Hybrid P2P Exchanges

Hybrid P2P exchanges combine the decentralized nature of peer-to-peer trading with centralized services like banking integration and advanced trading tools.

These platforms aim to offer a balanced experience that includes both user control and convenient support features. One good example is Zengo. It is ideal because it supports all the top-performing cryptos, and there are even many DeFi (decentralized finance) and NFT (non-fungible token) features.

Best of all, there’s no minimum deposit, and it’s free to sign up. If you live in the EU, US, or UK, Zengo is an option to consider..

This blend of features makes hybrid exchanges ideal for users who want the security of a DEX with the ease of use found in a CEX.

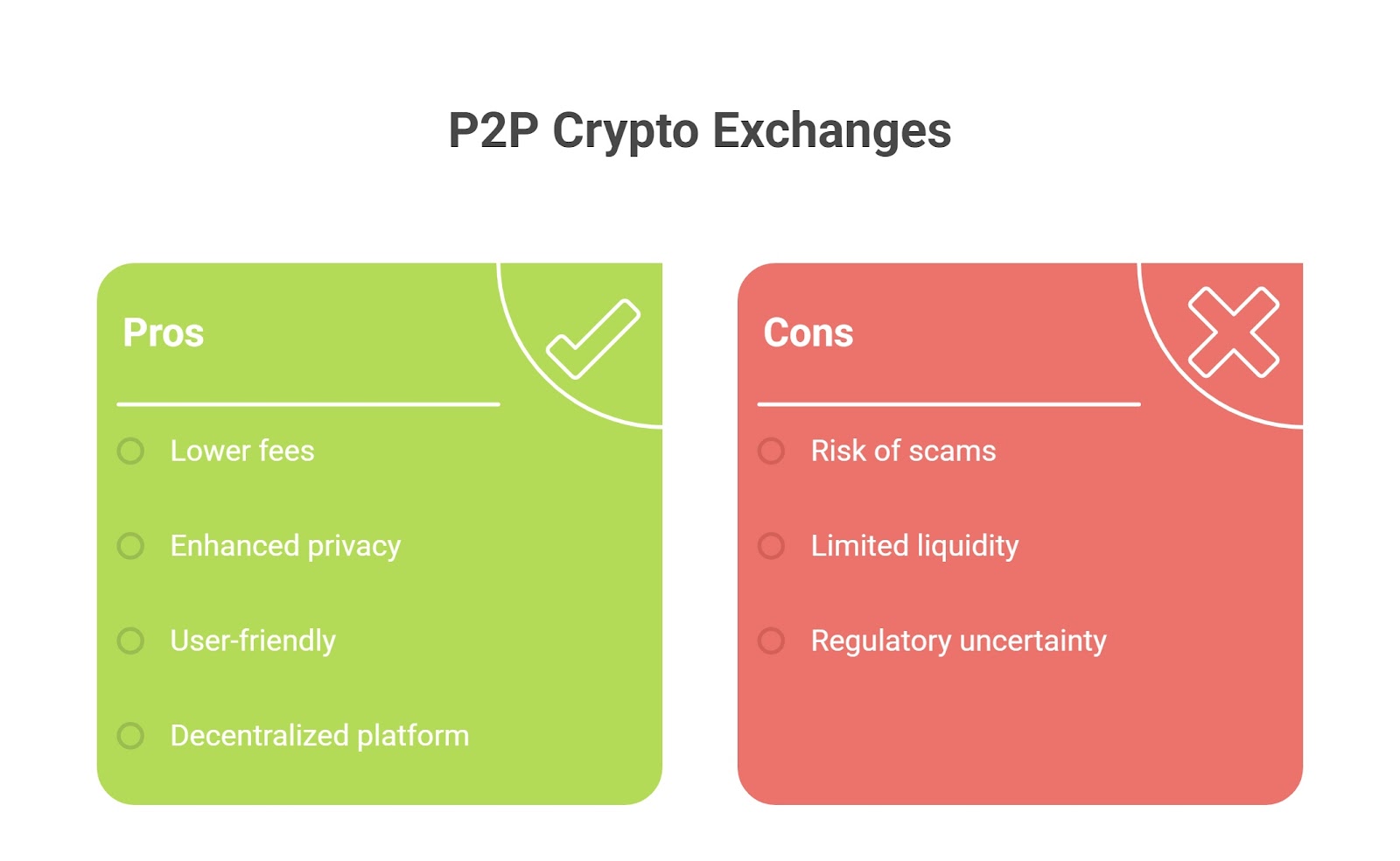

Advantages of Using P2P Crypto Exchanges

Here are seven key benefits of using P2P crypto exchanges:

1. Lower Transaction Fees

P2P exchanges often have lower fees compared to centralized platforms. Since there are no intermediaries, users can save on transaction costs.

For example, some platforms like Bitget P2P offer minimal fees, making trading more cost-effective for users.

2. Enhanced Privacy

P2P platforms typically require less personal information, allowing users to maintain greater privacy.

Unlike centralized exchanges that mandate extensive KYC procedures, P2P exchanges enable users to trade with minimal identity verification, appealing to those who value anonymity.

3. Greater Control Over Trades

Users have more control over their trades on P2P platforms. They can set their own prices, choose preferred payment methods, and negotiate terms directly with counterparts.

This flexibility allows for personalized trading experiences tailored to individual needs.

4. Diverse Payment Options

P2P exchanges support a wide range of payment methods, including bank transfers, digital wallets, and even cash.

This variety accommodates users from different regions and with varying access to financial services, enhancing the inclusivity of crypto trading.

5. Global Accessibility

P2P platforms are accessible worldwide, allowing users to trade cryptocurrencies across borders without restrictions.

This global reach is particularly beneficial in regions where centralized exchanges are limited or unavailable, promoting financial inclusion.

6. Enhanced Security Measures

Many P2P exchanges incorporate escrow services to secure transactions. The platform holds the seller’s cryptocurrency in escrow until the buyer confirms payment, reducing the risk of fraud.

Also, dispute resolution mechanisms are in place to handle any issues that arise during trades.

Disadvantages and Risks of P2p crypto exchange

Peer-to-peer (P2P) crypto exchanges also present certain risks and disadvantages that users should be aware of:

1. Risk of Fraud and Scams

In P2P trading, users interact directly, which can expose them to fraudulent activities. Scammers may pose as legitimate traders, leading to potential loss of funds.

For instance, a buyer might claim they haven’t received the cryptocurrency after making payment, or a seller might disappear after receiving payment without releasing the crypto.

To mitigate these risks, it’s advisable to use reputable P2P platforms that offer escrow services and user verification systems.

2. Limited Regulatory Oversight

Many P2P exchanges operate with minimal regulatory oversight, which can be a double-edged sword.

While it offers more freedom, it also means there’s less protection for users in case of disputes or fraudulent activities.

Without a central authority, resolving issues can be challenging, and users may have limited recourse if something goes wrong.

3. Security Concerns

The decentralized nature of P2P exchanges can make them targets for cyberattacks. You are responsible for securing your own wallets and private keys.

If your credentials are compromised, your funds can be stolen without the possibility of recovery. It’s important to implement strong security measures, such as two-factor authentication and using secure, reputable wallets.

4. Liquidity Issues

P2P platforms may have lower liquidity compared to centralized exchanges. This means it might be harder to find a buyer or seller for certain cryptocurrencies, especially less popular ones.

Lower liquidity can lead to wider spreads between buy and sell prices, making trades less favorable for users.

5. Price Volatility Risks

Cryptocurrency prices can be highly volatile. In P2P trading, delays in transaction completion can lead to significant price changes between the agreement and the actual transfer.

This volatility can result in unexpected losses or gains, making it crucial for traders to act promptly and stay informed about market conditions.

Popular P2P Crypto Exchanges in 2025

Here are the popular peer-to-peer (P2P) cryptocurrency exchanges in 2025, each offering unique features to cater to diverse trading needs:

1. Binance P2P

Binance P2P is a widely used platform, supporting over 350 cryptocurrencies and more than 300 payment methods, including bank transfers, mobile payments, and cash deposits.

It operates in over 190 countries, making it accessible to a global audience.

The platform employs multi-factor authentication (MFA), Know Your Customer (KYC) procedures, and an escrow service to enhance security.

Pros

- Extensive range of supported cryptocurrencies and payment methods

- High liquidity for quick transactions

- Robust security measures, including MFA and KYC

- Global accessibility

- User-friendly interface

Cons

- Transaction fees up to 0.35%

- Complex interface due to numerous features

- Mandatory KYC may deter privacy-focused users

- Potential delays during high-traffic periods

- Limited customer support response times

2. Paxful

Paxful is known for its user-friendly interface and supports over 300 payment methods, such as bank transfers, mobile wallets, and gift cards. It primarily focuses on Bitcoin, USDT, Ethereum, and USDC.

The platform operates in more than 200 countries and employs two-factor authentication (2FA), KYC (for high-volume transactions), and an escrow service for security.

Pros

- Wide variety of payment options

- No fees for buyers

- Secure transactions with escrow protection

- Accessible in numerous countries

- Reputation system to build trust among users

Cons

- Seller fees up to 1%

- Some payment methods may not be available in all regions

- Limited cryptocurrency options

- Potential for scams if users are not cautious

- Customer support can be slow to respond

3. Bybit P2P

Bybit P2P offers a straightforward interface and is known for its well-organized customer support. It supports over 20 cryptocurrencies and payment methods, including bank transfers and digital wallets.

The platform operates in more than 50 countries and employs MFA, KYC, and an escrow service to ensure secure transactions.

Pros

- No transaction fees (though payment processor fees may apply)

- User-friendly interface suitable for beginners

- Efficient customer support

- Secure trading environment with escrow protection

- Supports multiple fiat currencies

Cons

- Limited number of supported cryptocurrencies and payment methods

- Smaller user base compared to larger platforms

- Requires KYC verification

- Potential delays in transaction processing

- Less liquidity than more established exchanges

4. OKX P2P

OKX P2P is suitable for users focusing on Bitcoin, Ethereum, and Tether. It supports over 20 payment options, including bank transfers and electronic wallets, and operates in more than 100 countries.

The platform offers zero transaction fees and employs MFA, KYC, and an escrow service for secure trading.

Pros

- No transaction fees

- Secure transactions with escrow protection

- User-friendly interface

- Supports a variety of payment methods

- Accessible in numerous countries

Cons

- Limited to a few cryptocurrencies for P2P trading

- Requires KYC verification

- Customer support may be limited

- Potential for lower liquidity compared to larger platforms

- Some payment methods may not be available in all regions

5. KuCoin P2P

KuCoin P2P is known for its focus on security and ease of use. It supports a variety of cryptocurrencies, including Bitcoin, Tether, Ethereum, KuCoin’s native KCS token, and USD Coin, and offers over 100 payment methods.

The platform operates in over 200 countries and employs KYC verification and an escrow service for secure transactions.

Pros

- No trading fees for P2P transactions

- Strong security protocols, including KYC verification

- User-friendly interface

- Supports a wide range of payment methods

- High liquidity for quick transactions

Cons

- Limited number of supported cryptocurrencies

- Requires KYC verification

- Some advanced features may be lacking

- Customer support can be slow to respond

- Potential for scams if users are not cautious

6. Bitget P2P

Bitget P2P is known for offering zero fees on P2P trades and supports multiple cryptocurrencies. It provides a simple and efficient interface, making it a preferred choice among traders looking to diversify their crypto holdings.

Pros

- No trading fees for P2P transactions

- Supports multiple cryptocurrencies

- Simple and efficient interface

- Secure transactions with escrow protection

- Reliable platform for cost-effective trading

Cons

- Limited number of payment methods

- Requires KYC verification

- Smaller user base compared to larger platforms

- Potential for lower liquidity

- Customer support may be limited

7. LocalBitcoins

LocalBitcoins is one of the oldest P2P cryptocurrency exchange platforms, allowing users to buy and sell Bitcoin directly with one another using various payment methods. It operates in over 190 countries and offers escrow protection to ensure secure transactions.

Pros

- Global reach with users in over 190 countries

- Multiple payment methods, including bank transfers and PayPal

- Escrow protection for secure transactions

- Reputation system to build trust among users

- User-friendly interface

Cons

- Limited to Bitcoin trading

- Requires KYC verification

- Potential for scams if users are not cautious

- Customer support can be slow to respond

- Some payment methods may not be available in all regions

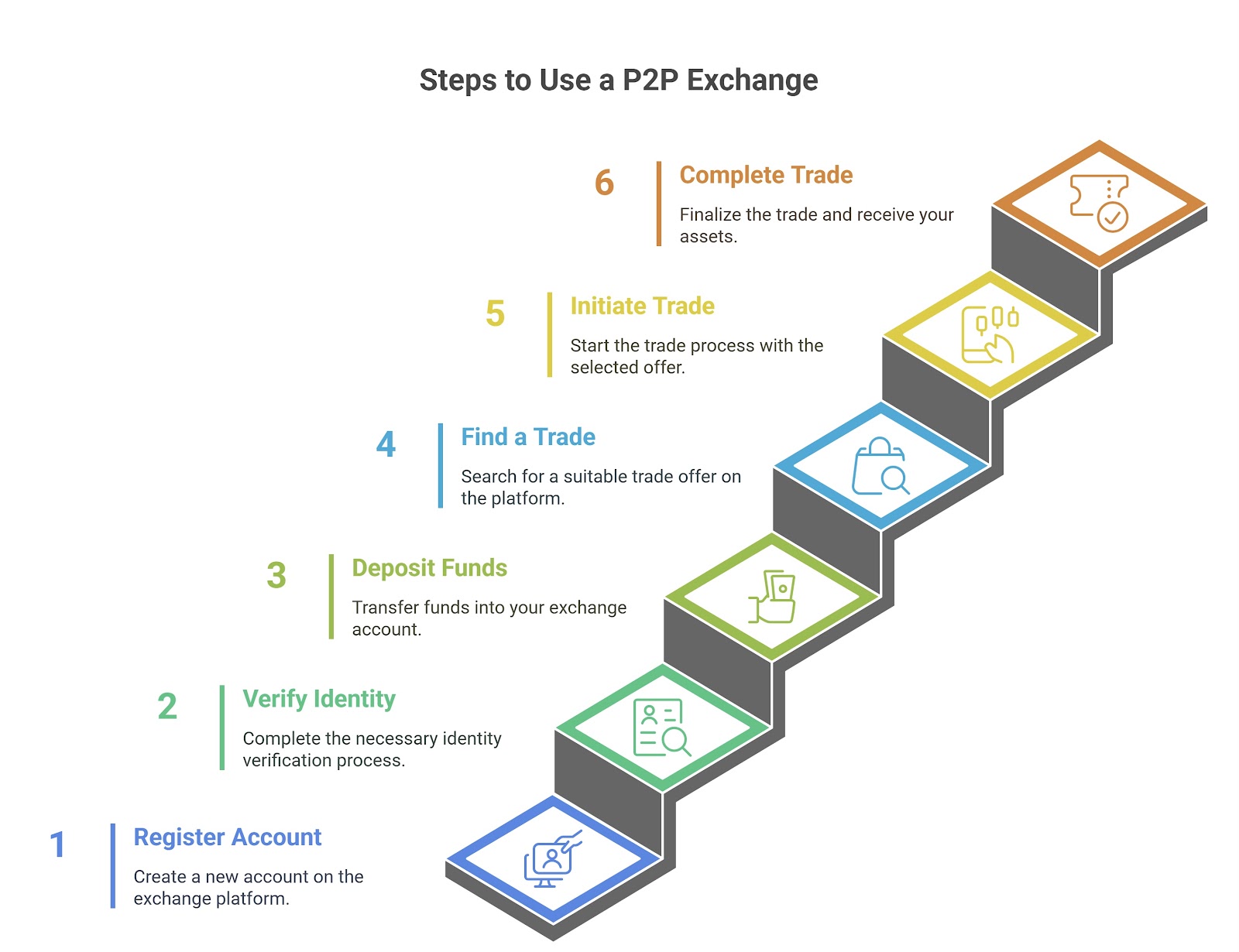

How to Use a P2P Exchange (Step-by-Step)

Here’s a simple, step-by-step process on how to use a P2P crypto exchange. Each step explains how to trade safely and confidently on a peer-to-peer platform.

1. Setting Up an Account

To start using a P2P exchange, the first step is to create an account on the platform of your choice like Binance P2P, Paxful, or KuCoin P2P. You’ll need to provide a valid email address or phone number and create a secure password.

Some platforms may also ask you to enable two-factor authentication (2FA) for extra security.

Once your account is created, you can explore the trading dashboard and get a feel for how the platform works.

2. Completing KYC (if required)

Many P2P platforms require Know Your Customer (KYC) verification before you can trade. This usually involves uploading a government-issued ID, a selfie, and sometimes a proof of address. KYC helps prevent fraud and ensures a safer trading environment.

On platforms like Binance or OKX, KYC is necessary to access full trading features, while some platforms like LocalBitcoins may allow small trades without it. Always check what level of verification is needed.

3. Searching for Trades

Once your account is ready, you can start browsing available buy or sell offers. Use the search filters to select your preferred cryptocurrency, payment method (like bank transfer, PayPal, or mobile money), and currency.

The platform will show you a list of potential trading partners. Each offer includes the trader’s rate, reputation score, completion rate, and limits. It’s best to choose a user with a high rating and lots of completed trades for a smoother experience.

4. Initiating and Completing a Trade

To start a trade, click on the offer that suits your needs and enter the amount you want to buy or sell. The platform will open a live chat window between you and the counterparty.

You’ll follow the on-screen instructions to send payment or wait to receive it, depending on your role in the trade. Always communicate through the platform, and avoid sharing personal or sensitive information.

5. Using Escrow Services Safely

Escrow is a major feature of P2P platforms. It holds the seller’s crypto safely during the trade. Once the buyer sends the payment and clicks “Paid,” the platform holds the crypto until the seller confirms receipt. After the confirmation, the crypto is released to the buyer.

If there’s any disagreement, the platform can step in to resolve the issue using the escrowed funds. Never mark a trade as paid if you haven’t actually sent or received the payment doing so may lead to disputes.

6. Finalizing a Transaction

After the trade is completed and both parties confirm the transaction, the crypto is transferred to the buyer’s wallet. You can then leave a rating or feedback for your trading partner.

This helps build trust on the platform. It’s also a good idea to move your crypto to a personal wallet for safekeeping, especially if you’re not planning to use it right away.

Security Measures and Best Practices for using P2P crypto exchanges.

This section focuses on the security measures and best practices for using P2P crypto exchanges.

1. Verifying User Reputation and Feedback

Before starting any trade, always check the other user’s reputation on the platform. Most P2P exchanges display a trader’s profile showing their total number of completed trades, feedback ratings, and user comments.

A high completion rate and lots of positive feedback usually mean the trader is reliable. It’s a good idea to avoid users with low ratings, incomplete profiles, or negative reviews, even if their prices look attractive.

2. Avoiding Off-Platform Transactions

Always complete your transactions within the platform. Scammers often try to move communication to messaging apps or suggest sending payments outside the platform’s system.

This is risky because once you step outside the platform, you lose escrow protection and the ability to file a dispute. If someone insists on dealing off-platform, it’s a strong sign that you should cancel the trade and report them.

3. Understanding Escrow Protections

Escrow services are built-in safety tools on P2P platforms. When you start a trade, the platform holds the seller’s crypto in escrow until the payment is confirmed.

This ensures that the crypto won’t disappear before the buyer receives it. Never release your crypto or mark a transaction as paid before you actually receive the funds.

If something goes wrong, the platform can step in to review the trade and release the crypto accordingly if everything happened through their system.

4. Using 2FA and Secure Wallets

Two-factor authentication (2FA) adds an extra layer of security to your account. Enable it using apps like Google Authenticator or Authy. This makes it much harder for someone to access your account, even if they get your password.

Also, keep your crypto in a secure wallet either on the exchange (for active traders) or in a private wallet (for better long-term security).

For larger amounts, consider using a hardware wallet like Ledger or Trezor.

5. Dispute Handling and Communication Tips

Sometimes, a trade doesn’t go smoothly. Maybe the buyer claims they paid, but the seller hasn’t received anything. In such cases, open a dispute within the platform. Always stay calm and provide clear, honest information. Upload screenshots or receipts if needed.

Avoid using aggressive or emotional language, as support teams respond better to clear communication.

Most platforms have a resolution team that reviews the chat and transaction data to decide fairly.

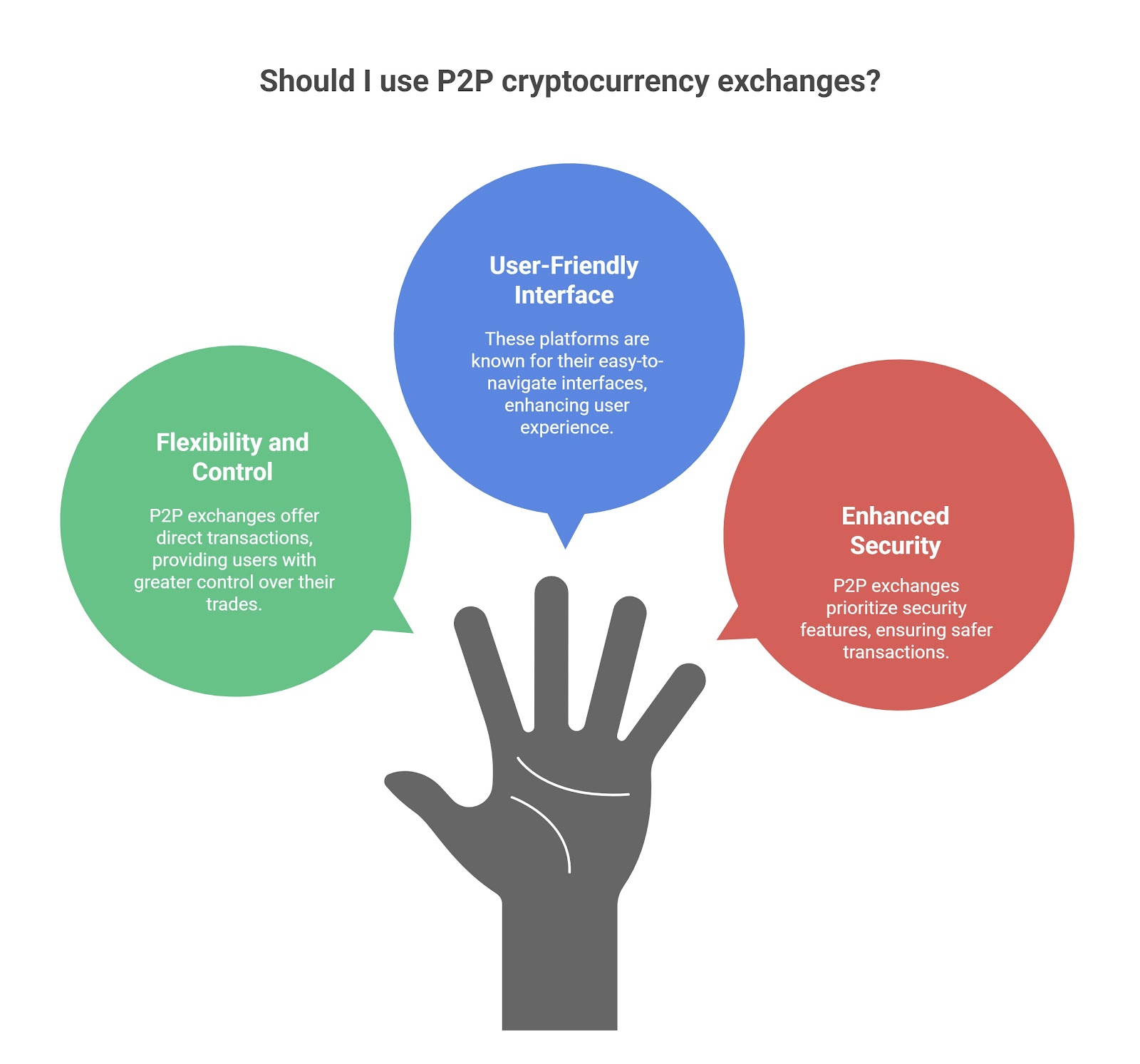

Conclusion

P2P crypto exchanges offer a flexible and user-controlled way to trade digital assets, allowing people to buy and sell directly without relying on a centralized platform. They support the main idea of decentralization in crypto by providing lower fees, local payment methods, and global access.

You can protect yourself and enjoy the full benefits of P2P trading by staying on the platform, checking user reputations, and enabling security features like 2FA.

With the right knowledge and precautions, P2P exchanges are a reliable and empowering tool in the crypto space.

Frequently Asked Questions

1. Are P2P crypto exchanges safe?

Yes, P2P crypto exchanges are generally safe when using platforms that offer escrow services, verified users, and dispute resolution systems.

2. Do P2P crypto exchanges require KYC?

Yes, many P2P crypto exchanges require KYC verification, especially for higher trade volumes or to access full platform features.

3. Can I trade anonymously on a P2P crypto exchange?

Yes, some P2P crypto exchanges allow limited anonymous trading, but most require basic identity verification to prevent fraud.

4. How do I stay safe when using P2P crypto exchanges?

To stay safe on P2P crypto exchanges, always use escrow, verify user ratings, avoid off-platform payments, and enable two-factor authentication.

5. Are there fees on P2P crypto exchanges?

Yes, most P2P crypto exchanges charge small fees, either through platform service fees or payment processor fees, depending on the trade type.

6. Can I buy Bitcoin on a P2P crypto exchange?

Yes, you can buy Bitcoin and other cryptocurrencies on P2P exchanges directly from other users using various local or digital payment methods.

No related posts.