What makes the price of Bitcoin rise one month and crash the next? Crypto market volatility remains one of the most discussed and misunderstood features of digital assets.

This article breaks down what drives these sharp price swings, how they impact the wider crypto ecosystem, and what could help stabilize the market over time.

Key Takeaways

- Crypto market volatility refers to the frequent and sharp changes in cryptocurrency prices.

- Factors like speculation, low liquidity, and global news play a major role in driving volatility.

- Volatility creates opportunities for traders but also increases risks for investors.

- Tools like the Volatility Index (CVX) and Bollinger Bands help track and measure crypto price swings.

- Events like Bitcoin halvings and exchange collapses have triggered major volatility in the past.

Definition of Market Volatility

Market volatility refers to the degree of price movement in a financial market over a specific period of time. When a market is volatile, prices tend to change quickly and by large amounts.

In crypto markets, this means the price of a coin or token can rise or fall sharply within minutes or hours. Volatility is often measured using indicators like standard deviation or average true range, but it’s majorly, it simply describes how much prices move up or down in a short time.

“The total market capitalization of cryptocurrencies fell from a high of $3.47 trillion to $3.22 trillion.”

Measuring Volatility in the Crypto Market

To understand crypto price swings, it’s important to know how market volatility is measured and tracked.

Common Volatility Metrics

Volatility in crypto is measured using tools and indicators that help traders understand how much a coin’s price moves over a specific period. One of the most common ways to measure this is historical volatility, which looks at past price movements.

It is calculated using standard deviation, a method that shows how much the price of a coin differs from its average.

If a coin’s price swings widely over time, its historical volatility will be high. Traders often look at this number to understand how risky an asset might be before making decisions.

Another popular metric is implied volatility, often used in crypto options trading. This shows how much the market expects a coin’s price to move in the future. It is based on the price of options contracts and gives traders a sense of the expected risk.

High implied volatility means traders are expecting big price moves, while low implied volatility suggests stability.

Although more common in traditional finance, this measure is becoming more relevant in crypto as more platforms offer options and other derivatives.

Other tools like the Average True Range (ATR) and Bollinger Bands also help traders track volatility. ATR shows how much a coin moves on average per day, and is helpful for setting stop-loss levels.

Bollinger Bands use a moving average and two standard deviations to create bands above and below the price. When prices move outside these bands, it signals increased volatility.

These tools are widely used in technical analysis and give simple visual cues about how volatile a market is.

Tools and Platforms for Volatility Tracking

Many traders rely on platforms that provide real-time data and charts to track market volatility. These tools offer easy ways to view historical movements, analyze trends, and compare the behavior of different cryptocurrencies.

Some of these platforms are beginner-friendly, while others offer more detailed analytics for experienced users. Choosing the right one depends on your level of experience and trading style.

Below are a few trusted tools used by traders and investors to monitor crypto volatility.

1. CoinMarketCap

CoinMarketCap is one of the most widely used platforms for tracking cryptocurrency prices and market data. While it is best known for showing live prices and rankings, it also offers detailed charts where users can see historical price movements.

You can get a quick sense of how volatile it is by checking a coin’s daily or weekly percentage changes.

CoinMarketCap also provides metrics like 24-hour trading volume, market cap, and circulating supply, which can help put price changes into context. A sudden increase in trading volume, for example, can be a sign of rising volatility.

The platform’s charting tools allow users to switch between different timeframes to view how much a coin moves during a specific period.

Although CoinMarketCap doesn’t have advanced volatility indicators like Bollinger Bands or ATR built-in, it gives a clear picture of how a coin has performed over time.

For beginners or casual investors, it is a simple and accessible place to start monitoring market behavior.

2. TradingView

TradingView is a powerful charting platform used by both crypto and traditional market traders. It offers a wide range of tools to track volatility, including Bollinger Bands, Average True Range, and custom scripts created by the community.

You can apply these indicators to any crypto chart to see how much the price is fluctuating.

What sets TradingView apart is its ability to create and save custom chart setups. You can track multiple coins, apply different volatility indicators, and set alerts for price changes.

This makes it useful for both short-term traders and long-term investors who want to stay ahead of sudden market movements.

TradingView also includes community insights, allowing users to share analysis and ideas. By combining personal chart setups with expert opinions, traders can better understand what’s driving volatility in the market. For anyone serious about crypto trading, this platform offers deep insights and flexibility.

3. CoinGecko

CoinGecko is similar to CoinMarketCap in how it provides price charts, market data, and volume metrics. It also tracks percentage changes over various timeframes, giving a quick overview of short-term and long-term volatility.

In addition, it includes useful stats like “volatility rank,” which compares the price swings of different coins.

CoinGecko allows users to view market cap dominance, historical data tables, and liquidity scores. These features help investors understand the stability of a coin.

For example, a coin with high trading volume and liquidity is less likely to face wild price swings from a single trade. This makes it easier to manage risk.

The platform is especially popular among DeFi users, as it lists many tokens that may not be found on other tracking sites. If you’re looking to measure volatility in both popular and lesser-known tokens, CoinGecko is a solid platform to use.

4. Glassnode

Glassnode focuses on on-chain data and provides insights into how market activity is affecting price movements.

While it doesn’t use standard technical indicators like ATR or Bollinger Bands, it shows investor behavior, wallet activity, and inflows or outflows from exchanges all of which help predict volatility.

One feature Glassnode offers is the tracking of “Realized Volatility,” which is based on actual price movements rather than estimates. This can help users spot periods of high or low volatility based on blockchain data.

For example, a spike in exchange inflows often signals that people are preparing to sell, which can lead to more price swings.

Glassnode is especially useful for long-term investors or analysts who want a deeper understanding of what’s happening under the surface.

It turns complex blockchain data into easy-to-read charts and gives context to why volatility might increase or decrease in the coming days.

“Bitcoin surged nearly 20% since January and reached a record high of $111,000 on May 22.”

Impacts of Volatility

Crypto market volatility affects everyone in the ecosystem, from individual investors to large-scale projects.

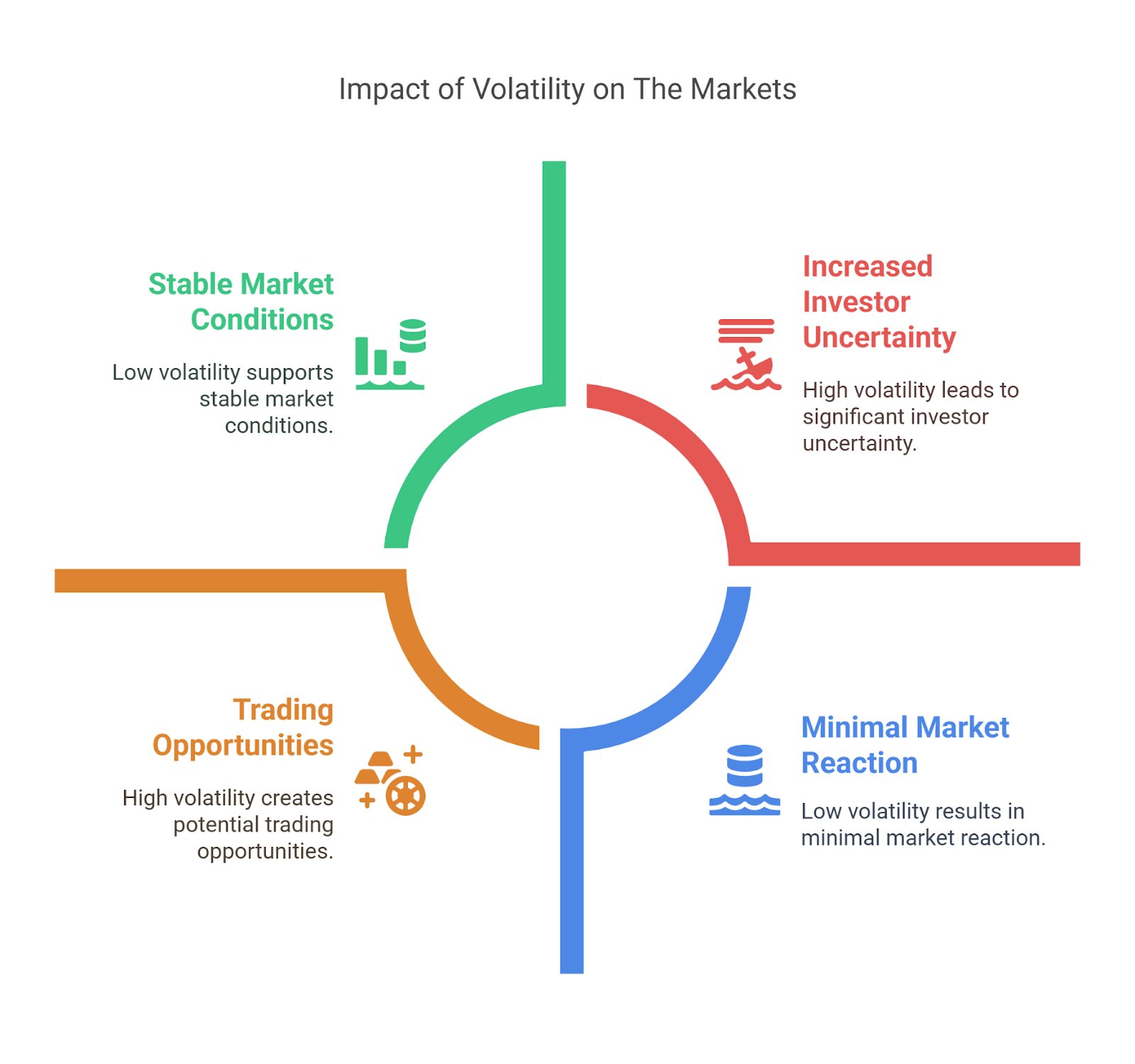

1. On Traders and Investors

Volatility has a strong effect on both new and experienced traders. High volatility creates more trading opportunities, especially for short-term traders who aim to profit from price swings.

When prices move fast, traders can enter and exit positions quickly and try to make profits from the ups and downs. However, these quick changes can also result in losses if trades go the wrong way.

For long-term investors, high volatility can be stressful. Someone who bought a cryptocurrency for the long run might see their investment drop by 20% or more in a few days.

This often causes emotional decisions, like selling at a loss out of fear. Even if the coin recovers later, the investor might have already exited the market. Managing emotions becomes important when dealing with volatile assets.

One example of this was during the 2022 bear market. Bitcoin dropped from over $60,000 to below $20,000 in a short time.

Many investors who entered the market in late 2021 saw their portfolios shrink quickly. While some stayed calm and held their assets, others sold in panic. This shows how volatility can cause both profit and loss, depending on how investors react.

2. On Crypto Projects and Startups

Volatility also affects crypto projects, especially newer startups. When the market is strong and prices are going up, it’s easier for projects to raise funds through token sales or venture capital.

Investors are more willing to support new ideas. But when the market becomes unstable, funding slows down and startups may struggle to continue building or expanding.

A falling market can also impact a project’s reputation. If the token price drops too much, users may lose trust. They might think the team is not delivering, even if the project is still active.

For example, some GameFi and NFT projects lost most of their value during the 2022 market crash. Even if the teams were still working, users left because the price drop reduced excitement and interest.

Startups that depend heavily on token sales or price performance face more pressure during volatile times. Teams may be forced to reduce staff, cut features, or pause development.

This slows down the entire roadmap. To stay stable, many new projects now focus on building real products and diversifying their income, rather than relying only on token value.

3. On the Broader Ecosystem

The wider crypto ecosystem feels the impact of market volatility across many areas. When prices fall sharply, trading volume often drops.

This affects centralized and decentralized exchanges, wallet providers, and payment platforms. Lower volume means fewer users, less revenue, and slower activity across the entire space.

Volatility can also shake trust in crypto as a financial system. If prices keep crashing or pumping without clear reasons, people outside the space may think the market is unsafe or unpredictable.

This makes it harder for crypto to gain acceptance among traditional institutions, governments, or new users. Regulatory pressure also increases during volatile periods, as authorities worry about investor protection.

In extreme cases, high volatility can trigger the collapse of major platforms. A clear example is the crash of FTX in 2022. A sudden drop in token value and liquidity problems caused a full platform shutdown, affecting millions of users.

The event had ripple effects on other companies and led to more caution across the space. These examples show how volatility is not just about price it influences the stability of the whole crypto industry.

4. On Stablecoins and DeFi

Stablecoins are meant to hold a fixed value, usually pegged to the US dollar. But during periods of market volatility, some stablecoins have failed to keep their peg.

If too many users try to redeem or sell a stablecoin at once, and the backing system is weak, the price can fall below $1. A well-known example is TerraUSD (UST), which collapsed in 2022. It lost its dollar peg and caused major losses across the ecosystem.

Volatility also affects decentralized finance (DeFi) protocols. In DeFi lending platforms, users deposit crypto as collateral to borrow assets. If the value of the collateral drops suddenly, it can trigger liquidations.

This means the system automatically sells the collateral to repay loans, which pushes prices down even more. It creates a feedback loop of falling prices and more liquidations.

Many DeFi users rely on stablecoins and collateralized loans to manage risk. When volatility increases, it becomes harder to predict what will happen next.

Platforms like Aave, Compound, and MakerDAO have added more risk control measures, like setting higher collateral ratios and updating price oracles quickly.

These steps help, but DeFi still remains sensitive to sudden price swings, especially when major coins like ETH or BTC move fast.

Volatility vs. Traditional Markets

Crypto markets are known for their extreme price swings, but how does this volatility compare to traditional assets like stocks, commodities, and forex

Comparing Crypto to Stocks, Commodities, and Forex

Cryptocurrencies are generally more volatile than traditional markets like stocks, commodities, and forex. One key reason is that crypto markets are still relatively young. Bitcoin only launched in 2009, while stock markets have been around for over a century.

This shorter history means fewer rules, less maturity, and more room for wild price swings. For example, it’s common for Bitcoin or Ethereum to move 5–10% in a single day, while major stocks like Apple or Microsoft usually move less than 2% during normal trading sessions.

Liquidity also plays a role. Traditional markets are more liquid, with higher trading volumes and deeper order books. When large amounts of money enter or exit a stock or commodity, the price doesn’t move as much.

In crypto, even medium-sized trades can shift prices significantly, especially for low-cap tokens. That’s why altcoins often show much bigger percentage moves than large-cap stocks or currencies.

Another factor is investor behavior. Traditional market participants include pension funds, banks, and long-term investors. These groups tend to trade based on fundamentals and have a longer investment horizon.

In contrast, the crypto market is driven more by sentiment, trends, and speculation. A single tweet or rumor can cause a coin’s price to surge or crash within hours. This crowd-driven nature makes the crypto market more sensitive and reactive than traditional assets.

How 24/7 Trading Affects Crypto Volatility

Unlike traditional markets, which usually operate during business hours and close on weekends or holidays, the crypto market is open 24/7. This constant trading window means that prices can change at any time of day or night.

It gives investors flexibility, but also adds pressure because there is no pause for analysis or reflection. News can break overnight, and prices can shift while most traders are asleep.

The 24/7 nature also reduces the time for markets to “cool off” after big events. In traditional finance, a company’s stock might drop after a poor earnings report, but trading halts overnight, allowing the market to absorb the news.

In crypto, there’s no break. When bad news drops, like a hack or regulatory action, the price can keep falling around the clock without a pause, often leading to sharper declines.

This continuous activity also invites more global participation. Traders from different countries react to events in their own time zones, which creates more price movement throughout the day. This global and non-stop structure can lead to unpredictable volatility patterns.

For example, if Asia wakes up to bullish news from the U.S., it might trigger a fresh wave of buying while U.S. traders are offline, pushing prices further in either direction.

Regulation and Its Influence on Market Stability

Regulation plays a major role in shaping how stable or volatile the crypto market becomes over time.

Regulatory Clarity as a Volatility Dampener

Clear and consistent regulation can help reduce crypto market volatility by setting rules that guide investor behavior, exchange operations, and project development.

When investors know what to expect from regulators, they are more likely to make steady, long-term decisions rather than reacting emotionally to uncertainty. Regulatory clarity gives both retail and institutional investors the confidence to enter the market with less fear of sudden legal surprises.

For example, when countries like Switzerland and the UAE established clear crypto frameworks, they attracted many blockchain companies and institutional players.

These environments provided clear guidelines around licensing, taxation, anti-money laundering (AML), and investor protection. As a result, trading activity in these regions grew in a more stable way, and large investors became more comfortable holding crypto assets.

Clarity also helps projects operate responsibly. When protocols know what is expected from them legally, they can design their tokenomics, governance, and compliance processes in ways that are less likely to attract penalties or sudden shutdowns.

This level of predictability reduces the risk of abrupt changes in user behavior, platform exits, or price shocks triggered by legal threats.

Crackdowns and Their Short-term Impact

On the other hand, sudden regulatory crackdowns can create sharp, short-term volatility in the market. These actions often trigger panic selling, especially when traders fear that access to certain services or tokens will be blocked.

A well-known example occurred in 2021, when China banned crypto mining. Bitcoin’s price dropped sharply, and many miners had to shut down or move their operations to other countries.

These announcements caused prices to dip quickly, as investors rushed to reduce exposure to tokens that might be affected.

Even rumors of regulatory action can cause fear, uncertainty, and doubt commonly known as FUD which often leads to increased volatility.

While crackdowns are often aimed at protecting users or enforcing the law, they tend to have short-term destabilizing effects.

However, the long-term result can sometimes be positive if it leads to clearer rules and safer market practices. Still, when regulation is unclear or inconsistently applied, the risk of sudden price shocks remains high, especially in reaction to enforcement news.

Case Studies of Major Volatility Events

To better understand crypto market volatility, it helps to look at real events that triggered massive price swings and shaped investor sentiment.

The 2021 Bull and Bear Cycle

The year 2021 was one of the most dramatic in crypto history, marked by a sharp bull run followed by a steep bear market. Bitcoin started the year at around $29,000 and reached an all-time high of nearly $69,000 in November.

Ethereum followed a similar path, climbing from under $800 to over $4,800. This surge was fueled by strong retail interest, institutional adoption, and hype around NFTs and DeFi.

However, the market turned quickly. By early 2022, prices had begun to fall. Bitcoin dropped below $40,000, and Ethereum fell below $3,000.

Several factors contributed to this reversal, including rising inflation, global economic uncertainty, and increasing regulatory concerns. These external conditions made investors more cautious, leading to widespread selling.

The speed and size of the correction highlighted how volatile crypto markets can be. In just a few months, billions in value were wiped out, and many retail investors faced heavy losses.

This cycle showed how sentiment, news, and macroeconomic factors could cause sharp price changes, both upward and downward, in a short time.

The Terra (LUNA) Collapse

In May 2022, the Terra ecosystem collapsed, triggering one of the biggest crashes in crypto history.

Terra’s algorithmic stablecoin, UST, was designed to stay pegged to the U.S. dollar using a complex system that involved its sister token, LUNA. When UST started to lose its $1 peg, investors panicked and rushed to exit both tokens.

As more people sold UST, the system responded by minting huge amounts of LUNA to try and restore the peg.

This caused LUNA’s value to crash from over $80 to less than a cent in just days. UST also fell far below $1, wiping out over $40 billion in combined market value. Many individual investors lost their savings, and trust in algorithmic stablecoins was badly damaged.

The Terra collapse had ripple effects across the crypto space. Platforms that had exposure to UST or LUNA faced liquidity issues, and DeFi protocols like Anchor Protocol, which offered high yields on UST deposits, also broke down.

The event brought out the dangers of unstable token mechanics and the importance of stress-testing stablecoin models in real-world conditions.

FTX Collapse and Exchange Risk

In November 2022, FTX, one of the largest crypto exchanges at the time collapsed almost overnight. The platform was known for its strong branding, global presence, and close ties to high-profile investors.

However, it was revealed that FTX had been misusing customer funds and had deep financial ties to its sister company, Alameda Research.

Once this information surfaced, users began rushing to withdraw their funds. FTX quickly became insolvent and halted withdrawals, leaving billions of dollars in customer assets frozen.

Bitcoin and other major cryptocurrencies dropped sharply as panic spread across the market. Many users who had trusted FTX lost access to their funds entirely.

The FTX collapse reminded the industry of the risks of centralized platforms, even those that appear well-established. It also pushed regulators around the world to take a closer look at crypto exchanges.

Since then, many investors have moved toward self-custody or decentralized alternatives, reinforcing the importance of transparency and trust in managing volatility and risk.

Bitcoin Halvings and Volatility Trends

Bitcoin halvings occur roughly every four years and reduce the block reward earned by miners by 50%. This built-in mechanism slows down the rate at which new Bitcoins enter circulation.

Historically, each halving has been followed by a strong price increase. After the 2016 halving, for instance, Bitcoin surged from around $600 to nearly $20,000 in 2017. The 2020 halving sparked another bull run, with Bitcoin reaching an all-time high of nearly $69,000 in November 2021.

These bullish periods, however, have often been followed by significant corrections. In 2018, Bitcoin lost more than 80% of its value after peaking the previous year. A similar pattern occurred after the 2021 high, with the market entering a prolonged bear phase through 2022.

These cycles show how halvings can fuel optimism and price growth, but also bring increased volatility as the market corrects or adjusts to new supply conditions.

“The most recent halving took place in April 2024, cutting the mining reward from 6.25 to 3.125 BTC per block.”

Future Outlook of Crypto Market Volatility

Looking ahead, several factors may influence whether crypto market volatility increases, stabilizes, or takes on a new form entirely.

Factors That May Stabilize the Market

One factor that could help reduce crypto volatility over time is increased market maturity. As more people adopt crypto and institutional investors enter the space, trading patterns may become more stable.

Large institutions often take a long-term approach and avoid sudden buy or sell decisions. Their involvement could add depth and liquidity to the market, making extreme price swings less common.

Better regulation is another factor. Right now, crypto is not fully regulated in many countries, which leaves room for speculation, manipulation, and scams.

As clear rules are introduced, especially around trading platforms, stablecoins, and investor protection, trust in the market may grow. This can attract more long-term investors and reduce panic-based trading, which often drives high volatility.

Wider use of real-world crypto applications can also help. If more people use crypto for daily payments, savings, or business, the market may become more utility-driven and less speculative.

A coin that is widely used, like a digital dollar or a blockchain-based remittance token, is less likely to see large and sudden value changes. Use-case-driven demand can offer price support during uncertain times.

Innovations That Could Reduce Volatility

Several technical innovations are being developed to make the crypto market more stable. One example is algorithmic risk management built into DeFi platforms.

These systems adjust collateral requirements or interest rates in real time, helping to prevent sudden crashes caused by liquidations. As these tools become more advanced, DeFi may become more predictable and less exposed to large swings.

Improved stablecoin models also play a role. Not all stablecoins are equally stable, some rely on algorithms, while others are backed by real assets.

Over time, newer stablecoins are being designed with stronger backing and more transparent audits. This builds confidence and helps maintain value during turbulent times. Projects like USDC and newer hybrid models are focusing on this area.

Blockchain upgrades can also reduce volatility by improving speed and lowering fees. When networks are congested or expensive to use, price swings often get worse due to delays and uncertainty.

Recent updates to Ethereum and layer-2 solutions like Arbitrum and Optimism aim to solve these issues. A faster and more efficient blockchain makes it easier for users and traders to react to market changes in real time.

The Role of AI and Predictive Analytics

Artificial intelligence and predictive analytics are becoming valuable tools in managing crypto volatility. These technologies help analyze large amounts of data from markets, news, and on-chain activity.

AI models can spot patterns that humans might miss and give early warnings about potential price changes or market stress. For example, a model could detect unusual whale movements or sudden spikes in social media mentions.

Traders and platforms are already using AI to improve strategies. Bots powered by machine learning can execute trades based on market signals, helping reduce losses during sharp moves.

Some also use AI to manage risk in portfolios by adjusting asset exposure depending on real-time conditions. As these systems get better, they could help smooth out reactions and reduce emotional trading.

On a larger scale, predictive tools might help exchanges and DeFi platforms respond to volatility before it spirals.

For instance, an AI system could adjust liquidity settings or pause trading during extreme market conditions, protecting users and reducing damage.

While AI won’t remove volatility completely, it may help turn chaotic markets into more manageable ones through better timing and data-driven decisions.

Conclusion

Crypto market volatility is a defining feature of the digital asset landscape, influencing every corner of the ecosystem from individual traders and long-term investors to startups, DeFi platforms, and global markets.

While this volatility creates both risk and opportunity, understanding its drivers such as supply shifts, market sentiment, regulation, and macroeconomic trends can help participants make more informed decisions.

As the market develops, innovations like predictive analytics, greater institutional participation, and clearer regulatory frameworks may help reduce extreme price swings.

Frequently Asked Questions About Crypto Market Volatility

Why is the crypto market so volatile?

The crypto market is volatile due to factors like low liquidity, speculative trading, limited regulation, and high sensitivity to news, social media, and global events.

Is crypto more volatile than stocks?

Yes, cryptocurrencies are generally more volatile than stocks because they trade 24/7, have fewer institutional investors, and are driven heavily by sentiment and speculation.

How does volatility affect crypto trading?

Crypto market volatility creates both risks and opportunities for traders, as it can lead to fast profits or losses depending on price movements.

Can market volatility crash the value of cryptocurrencies?

Yes, high volatility can lead to sharp market corrections or crashes, especially when triggered by negative news, regulation, or large-scale sell-offs.

What are the main causes of volatility in crypto?

The main causes of crypto volatility include speculative demand, low market liquidity, regulatory uncertainty, and external events such as hacks or economic shifts.

How can investors manage crypto volatility?

Investors can manage crypto volatility by diversifying their portfolio, using stop-loss orders, investing only what they can afford to lose, and staying updated on market trends.

Are stablecoins safe from market volatility?

Stablecoins are designed to resist volatility by being pegged to assets like the U.S. dollar, but algorithmic stablecoins or poorly managed ones can still lose their value.