In DeFi, speed and creativity fuel some of the most powerful financial tools, and crypto flash loans are a prime example. These unique, uncollateralized loans let users borrow large amounts of cryptocurrency instantly, as long as they repay it within the same transaction block.

Built entirely on smart contracts, flash loans have redefined how traders, developers, and arbitrageurs interact with decentralized finance protocols.

Unlike traditional borrowing, there’s no waiting, paperwork, or credit check involved. Everything executes in seconds, automatically and transparently.

That efficiency opens the door to both innovation and risk, making it essential to understand how flash loans work, where they’re used, and what to watch for, especially as more DeFi platforms support them.

Key Takeaways

- Flash loans are uncollateralized, instant crypto loans that must be repaid within a single blockchain transaction.

- Traders use flash loans for arbitrage, collateral swaps, and self-liquidation without needing upfront capital.

- Aave, dYdX, Uniswap, and Furucombo are leading platforms offering different levels of access to flash loan functionality.

- Flash loan attacks often exploit smart contract vulnerabilities or price oracles, posing major security concerns for DeFi protocols.

- Profits made from flash loan strategies may trigger taxable events and should be carefully tracked and reported to ensure compliance.

What Is a Flash Loan in Crypto?

A flash loan in crypto is an instant, uncollateralized loan that’s issued and repaid within a single blockchain transaction. It’s one of the most innovative features in decentralized finance (DeFi), made possible by smart contracts on networks like Ethereum.

Unlike traditional loans that require collateral or credit checks, flash loans allow users to borrow large sums of cryptocurrency instantly on the condition that the loan is repaid within the same blockchain transaction.

The concept relies entirely on smart contracts, which enforce the rules of the loan automatically. If the borrower fails to repay the full amount (including any fees) within that single transaction, the loan is reversed, and the transaction fails.

This “all-or-nothing” approach eliminates risk for the lender while giving users temporary access to capital for complex strategies like arbitrage, refinancing, or liquidation.

How Do Flash Loans Work in DeFi?

Flash loans operate entirely through smart contracts—self-executing programs that run on blockchains like Ethereum. These contracts make the entire borrowing and repayment process automatic, secure, and transparent.

Here’s a closer look at how flash loans actually work in DeFi:

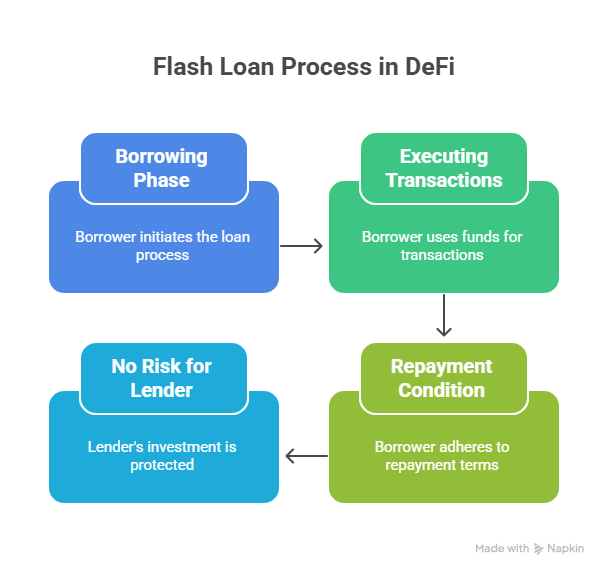

The Borrowing Phase

A user initiates a flash loan by interacting with a DeFi protocol that offers this service (like Aave or dYdX). The smart contract instantly lends the requested amount of cryptocurrency without requiring any collateral.

Executing Transactions With the Loan

After borrowing, the user can perform a series of predefined operations within the same transaction. These might include:

- Arbitrage between exchanges

- Swapping collateral positions

- Paying off a debt on another platform

- Exploiting price discrepancies or temporary opportunities

All of this happens within a single blockchain transaction.

The Repayment Condition

Before the transaction is finalized, the borrowed amount, plus a small fee, must be repaid. If the full repayment does not occur within that same transaction block, the smart contract automatically cancels everything.

That means all operations are reversed, and the blockchain returns to its original state as if nothing happened.

No Risk for the Lender

Because the loan is either repaid instantly or fails completely, lenders face no risk of default. This unique structure is what makes flash loans possible without collateral.

Common Use Cases for Flash Loans

Flash loans are powerful tools for executing complex financial operations within seconds. Since they provide instant, uncollateralized access to capital, they are often used for strategies that benefit from speed and automation.

Below are the most common use cases for flash loans in DeFi:

Arbitrage Trading

Arbitrage is one of the most popular uses for flash loans. It involves taking advantage of price differences for the same asset across different decentralized exchanges.

A user can borrow funds via a flash loan, buy an asset on one platform where it’s cheaper, and immediately sell it on another platform at a higher price—all within one transaction. The profit is used to repay the loan and keep the difference.

Collateral Swapping

In DeFi lending platforms, users often need to maintain specific collateral types to secure loans. Flash loans allow users to instantly swap one type of collateral for another without needing to close their existing loan.

This can help optimize borrowing conditions or respond quickly to market volatility, all without interrupting the loan structure.

Self-Liquidation of Loans

Flash loans can also be used to repay an existing loan in full, retrieve the collateral, and potentially reborrow on better terms.

This process, known as self-liquidation, helps users avoid forced liquidation fees and reduce interest costs. It’s especially useful when the collateral is at risk of falling below the required threshold.

Other Advanced DeFi Strategies

Beyond these common tactics, flash loans are also used in more complex strategies like yield farming optimizations, liquidity pool rebalancing, and governance-related actions.

Developers and advanced users may chain together multiple smart contracts to automate high-frequency transactions that would be too expensive or risky without flash loan access.

Flash Loans vs. Traditional Loans

Flash loans and traditional loans serve the same fundamental purpose—borrowing capital—but they operate on entirely different principles.

Here’s a breakdown of how they compare across key aspects:

Collateral Requirements

Traditional loans require borrowers to provide collateral, such as property or crypto assets, to secure the loan. This helps reduce risk for the lender in case of default.

Flash loans, by contrast, are completely uncollateralized. The security comes from the design of the smart contract, which enforces immediate repayment within a single transaction.

Repayment Terms

In traditional finance, loans are repaid over a set period—weeks, months, or even years—with interest.

Flash loans must be repaid instantly, within the same block of the transaction. If the repayment doesn’t occur, the entire transaction is automatically reversed.

Accessibility

Traditional loans often involve background checks, credit scores, and paperwork, making the process time-consuming and often restrictive.

Flash loans are open to anyone who can write or interact with smart contracts. There’s no approval process, and the loan is executed automatically.

Use Cases

Traditional loans are typically used for personal expenses, business growth, mortgages, or long-term investments.

Flash loans are primarily used for short-term DeFi strategies like arbitrage, loan refinancing, and collateral optimization.

Risk and Control

Lenders take on more risk with traditional loans, as there’s always a chance of borrower default.

In flash loans, the risk to the lender is minimal because repayment is enforced at the smart contract level. If repayment fails, nothing changes on the blockchain.

Flash Loan Attacks and Security Risks

While flash loans are a powerful tool in DeFi, they’ve also become a common vector for exploits. Because these loans require no collateral and offer instant access to large sums of capital, bad actors can use them to manipulate protocols and drain funds—all within a single transaction.

How Flash Loan Attacks Work

In a typical flash loan attack, the attacker borrows a large amount of crypto and uses it to exploit vulnerabilities in a smart contract. This might involve manipulating token prices, taking advantage of flawed lending mechanisms, or triggering a liquidation event.

The attacker then repays the flash loan within the same transaction—keeping the stolen profits while leaving the protocol with losses.

Price Oracle Manipulation

One of the most common attack methods involves price oracles, which are used by DeFi platforms to determine asset values.

If an oracle relies on decentralized exchanges for pricing, an attacker can use a flash loan to temporarily move the price of an asset and then exploit that incorrect valuation—either to borrow more than they should or to force a liquidation.

Smart Contract Vulnerabilities

Flash loan attacks often succeed because of poorly written or unaudited smart contracts. If a DeFi protocol does not handle inputs, pricing, or collateral logic correctly, attackers can exploit those flaws in seconds. Even a small oversight in contract logic can be devastating when large sums are at stake.

Real-World Examples

Notable flash loan attacks have affected major protocols like bZx and Harvest Finance. These incidents often result in millions of dollars being drained in a matter of seconds, eroding user trust and damaging the credibility of DeFi platforms.

Mitigation Strategies

To reduce the risk of flash loan attacks, developers can:

- Use robust oracles like Chainlink that are harder to manipulate

- Implement rate limits or transaction size caps

- Require multi-block execution for sensitive operations

- Conduct independent smart contract audits before launching

Best Platforms That Offer Flash Loans

Flash loans are available on several leading DeFi platforms, each with its own design, strengths, and limitations.

Below is an in-depth look at four major platforms that support flash loans:

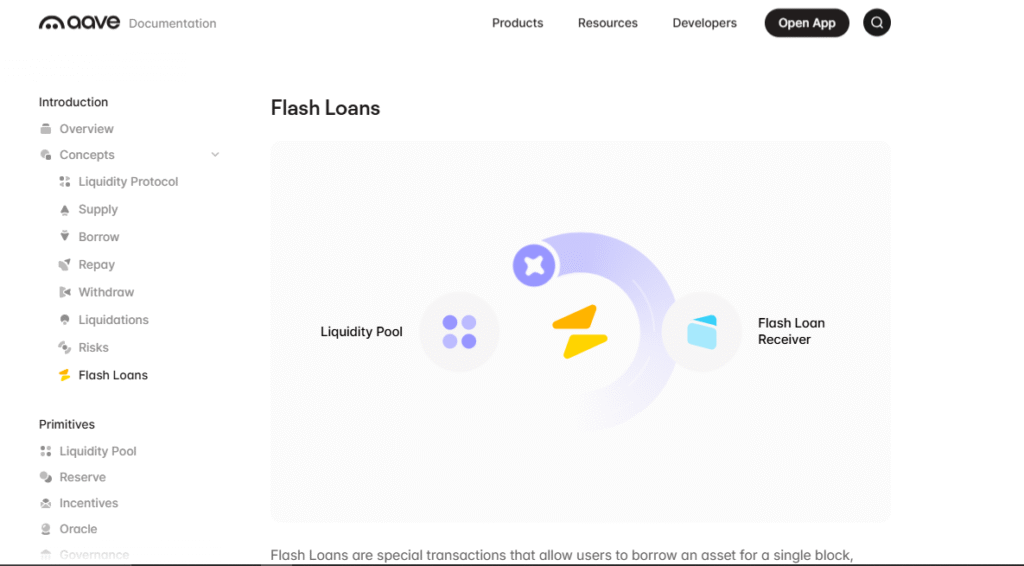

Aave

Aave is one of the earliest and most well-known platforms to introduce flash loans. Built on Ethereum and other EVM-compatible chains, Aave allows users to borrow funds without collateral—as long as the loan is repaid within the same transaction block.

How It Works

Users write custom smart contracts that interact with Aave’s lending pool. Once the loan is initiated, it must be repaid with a small fee (usually 0.07% in Aave V2, 0.05% in Aave V3) in the same transaction, or it is reverted automatically.

Pros

- Reliable and widely used protocol

- Supports a large number of tokens and markets

- Strong developer documentation and community

- Integrated with multiple DeFi tools

Cons

- Requires custom smart contract development

- Can be costly due to Ethereum gas fees

- High competition for arbitrage opportunities

dYdX

dYdX is a decentralized derivatives and margin trading platform that also supports flash loans through its smart contract infrastructure. While not as well-known for flash loans as Aave, dYdX offers them on a smaller scale with a focus on advanced trading strategies.

How It Works

dYdX’s smart contracts allow for flash loan functionality by enabling users to borrow, execute, and repay in one atomic transaction. The platform is mainly used by traders and developers integrating margin strategies or rebalancing portfolios.

Pros

- Integrated with advanced trading features

- Low borrowing fees

- Built-in support for margin and perpetuals

- More flexibility for trading-focused use cases

Cons

- Fewer supported assets than Aave

- Limited documentation for flash loan-specific use

- Not beginner-friendly for non-traders

Uniswap (via Flash Swaps)

Uniswap doesn’t offer flash loans in the traditional sense, but it supports flash swaps, which allow users to withdraw tokens from a liquidity pool and use them immediately, as long as they return the required value by the end of the transaction.

How It Works

In a flash swap, users can access one or both tokens from a Uniswap pool without upfront payment.

They can then use these tokens in other operations (e.g., arbitrage or liquidation), and repay the value plus a fee within the same transaction.

Pros

- No upfront capital needed for swaps

- Deep liquidity across thousands of token pairs

- Simple to integrate with DeFi arbitrage strategies

- Available on Ethereum and Layer 2 networks

Cons

- Limited to assets with liquidity on Uniswap

- Requires smart contract logic to ensure repayment

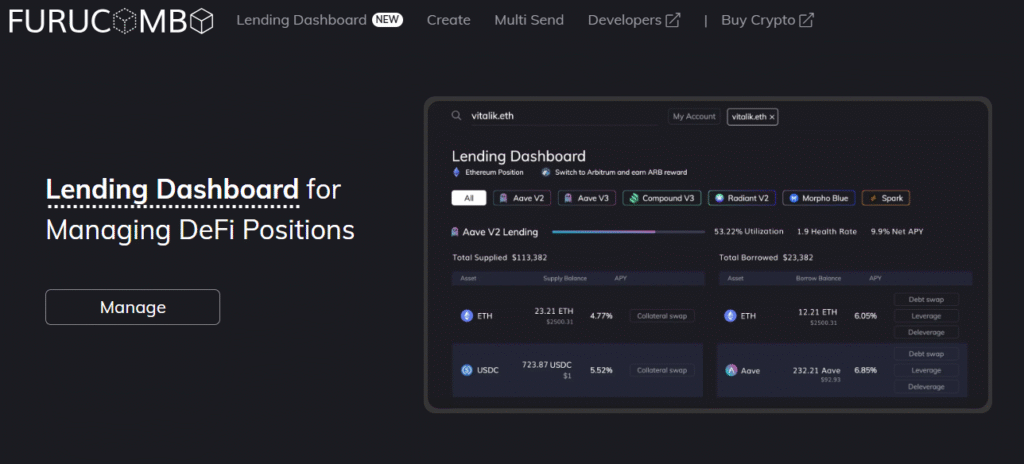

Furucombo

Furucombo is a DeFi aggregator that offers a no-code interface for building complex DeFi strategies, including flash loans, by visually connecting different protocol actions. It’s ideal for users who want to explore flash loans without writing custom smart contracts.

How It Works:

Users drag and drop actions (like borrowing, swapping, and repaying) into a “combo” and execute the strategy in one transaction. Furucombo handles the backend logic and integrates with platforms like Aave to execute flash loans.

Pros

- User-friendly, no coding required

- Supports multiple DeFi protocols in one workflow

- Good for prototyping strategies and testing arbitrage

- Ideal for fast execution of complex combos

Cons

- Limited to supported protocols (Aave, Uniswap, etc.)

- Less flexibility than custom coding

- Still requires gas fees and can fail if logic isn’t precise

Regulatory and Tax Implications

Flash loans operate in a highly technical and decentralized space, but they are not immune to legal and tax oversight.

As DeFi continues to grow, regulators are paying closer attention to the financial activities taking place on-chain, including those involving flash loans.

Legal Grey Areas

Flash loans are legal in most jurisdictions, but they exist in a regulatory grey zone. Since there is no centralized intermediary, identity verification (like KYC/AML) is typically absent. This makes it difficult for regulators to track who is borrowing, how much, and for what purpose.

While executing a flash loan is not illegal, using one to manipulate markets, exploit protocol vulnerabilities, or commit fraud can lead to criminal charges. Several high-profile flash loan attacks have drawn regulatory attention, especially when millions in user funds were lost or laundered through mixers.

Taxable Events

From a tax perspective, flash loan activities may trigger taxable events depending on how the funds are used. For example:

- Profits from arbitrage using a flash loan are generally considered capital gains or income and may be subject to tax.

- Token swaps performed during a flash loan may also be treated as taxable events, depending on the jurisdiction.

- Even though the borrowed amount is repaid instantly, any gain retained from the transaction is typically taxable.

In many countries, it is the responsibility of the user to report these earnings accurately, even if they occur within seconds and are settled within a single transaction.

Lack of Clear Guidance

Currently, most tax authorities, including the IRS (U.S.), HMRC (U.K.), and others, have not released specific guidance on flash loans.

Users must often interpret general crypto taxation rules and apply them to flash loan-related income. This creates uncertainty, especially for high-frequency or automated strategies.

What Users Can Do

- Keep detailed records of each flash loan transaction, including inputs, outputs, and any profit made.

- Use crypto tax software that supports DeFi activity to track and report gains.

- Stay informed about local regulations, especially if involved in frequent flash loan strategies.

- Consult a tax professional with crypto experience to avoid compliance issues.

Final Thoughts

Flash loans bring speed, flexibility, and unique opportunities to decentralized finance. From arbitrage to collateral swaps, they unlock powerful strategies with minimal barriers if used correctly.

But alongside the potential come technical and regulatory risks that users must take seriously. As more platforms support flash loans and tools become easier to use, staying informed and cautious is essential. For traders, developers, or curious users, understanding how flash loans work is key to using them effectively within the DeFi space.

Frequently Asked Questions

What Is a Flash Loan in Crypto?

A flash loan in crypto is an uncollateralized loan that must be borrowed and repaid within the same blockchain transaction, typically used for fast DeFi strategies like arbitrage or collateral swaps.

Are Flash Loans Still Profitable?

Yes, flash loans can still be profitable, but opportunities are highly competitive and often require advanced strategies, low gas fees, and precise execution.

What Happens if You Don’t Pay Back a Flash Loan?

If you don’t repay a flash loan within the same transaction, the entire operation is automatically reversed, and no funds are transferred.

Are Crypto Loans Safe?

Crypto loans can be safe when taken from reputable platforms with strong security and smart contract audits, but they still carry risks like smart contract bugs, market volatility, and liquidation.

How Long Do Flash Loans Last?

Flash loans last only for the duration of a single blockchain t