With volatile prices and multiple transactions clouding the picture, calculating your crypto profit can feel like navigating a complex maze.

But here’s a striking fact: over 75% of cryptocurrency investors experience losses. As such, it is a big deal when you make profit in your crypto trade.

So if you’re ready to take control and learn how to calculate your crypto profit with simple tips anyone can follow, you’ve come to the right place. This guide breaks down everything you need to know so you never lose track of your hard-earned gains again.

Key Takeaways

- Your crypto profit depends on the difference between your purchase cost (including fees) and its selling price. Always track fees to avoid inflating your actual gains.

- Whether you’re HODLing, trading, staking, or yield farming, each method involves unique considerations for calculating and tracking profits.

- Profits only count as taxable income when you sell or trade crypto. Until then, they remain unrealized and do not trigger tax obligations in most jurisdictions.

- Portfolio trackers and crypto tax software can help manage complex trades, apply accounting methods like FIFO or LIFO, and generate accurate reports.

- Keeping detailed transaction histories, including fees, rewards, and trade dates, ensures correct profit calculation and compliance with tax laws.

Why Calculating Your Crypto Profit Is Important

Your crypto profit offers you financial gain through buying and selling cryptocurrencies. It’s the difference between what you paid for your crypto assets (your cost basis) and the amount you receive when you sell or exchange them.

This profit can be realized or unrealized. When it is realized, this means you’ve sold your assets and locked in the gain. It also reflects the current value of your holdings if you haven’t sold yet. Calculating your crypto profit helps you measure how successful your investments are and guides your future decisions.

It also helps you understand the actual performance of your investments, so you can make informed decisions about buying, selling, or holding assets. Accurate profit calculation is essential for tax reporting, as some countries treat crypto gains as taxable income or capital gains.

So, failing to calculate profit correctly can lead to overpaying taxes or facing penalties. Knowing your profit helps you track your financial goals and optimize your investment strategy over time.

“Over 75% of cryptocurrency investors experience losses, so when you make a profit, it’s a milestone worth tracking with precision.”

Types of Crypto Investments

There are different ways you can choose to invest in cryptocurrency. This guides how profits are made and calculated. Each investment type involves unique strategies, risks, and profit potentials.

Buying and Holding (HODL)

This strategy involves purchasing cryptocurrencies and holding onto them for the long term, regardless of short-term market fluctuations. Investors believe in the asset’s potential growth over time and aim to sell when prices peak, realizing significant profits.

Calculating profit here is often straightforward: the difference between the purchase price and the sale price. However, it requires patience and market awareness.

Trading (Day Trading, Swing Trading)

Trading involves buying and selling cryptocurrencies over shorter periods to capitalize on market volatility.

Day trading focuses on quick trades within a single day, while swing trading holds assets for days or weeks to catch price swings. Profits come from frequent transactions, making tracking gains and losses more complex due to many trades and transaction fees.

Staking and Yield Farming

Staking involves locking up cryptocurrencies in a network to support blockchain operations, earning rewards in return.

Yield farming is similar but usually involves lending or providing liquidity in decentralized finance (DeFi) platforms to earn interest or tokens. Profits from these activities include rewards plus any appreciation in token value, which can complicate profit calculations.

How Crypto Prices Affect Profit

Cryptocurrency prices are highly volatile, changing rapidly due to market demand, news, regulations, and broader economic factors. This volatility means your crypto profit can fluctuate daily. So, unrealized profits can quickly turn into losses if prices drop.

Monitoring price trends and timing your trades or sales is key to maximizing profit. Additionally, price changes affect the valuation of staking rewards and yield farming returns, making real-time tracking important.

“Your profit is simply the difference between what you paid for a crypto asset and what you received when you sold it, but the journey to that number requires careful tracking.”

Key Concepts to Calculate Your Crypto Profit

Before calculating your crypto profit, it’s important to understand several fundamental concepts that affect how profits are measured and reported.

Cost Basis

Cost basis is the original value or purchase price of your cryptocurrency, including any fees or commissions paid during acquisition. It serves as the starting point for calculating profit or loss.

For example, if you bought 1 Bitcoin for $100,000 and paid $200 in fees, your cost basis is $100,200. Knowing your accurate cost basis is essential because it determines how much you’ve actually invested and helps calculate your true gains.

- Realized Gains are profits you have locked in by selling or exchanging your cryptocurrency. Once you sell, the gain becomes taxable income or capital gain, depending on your jurisdiction.

- Unrealized Gains refer to the increase in value of your crypto holdings that you still own but haven’t sold yet. These gains are “on paper” and can fluctuate with market prices. While unrealized gains affect your portfolio value, they don’t trigger taxes until the asset is sold.

Knowing the difference helps you track your actual profits versus potential profits, aiding in better decision-making and tax planning.

Fees and Taxes

Transaction fees, such as exchange fees, network (miner) fees, and withdrawal fees, reduce your overall profit. Ignoring these fees can lead to overestimating your earnings. Similarly, taxes can significantly impact net profit.

Different countries have varying rules for taxing crypto profits, including short-term vs. long-term capital gains rates, and sometimes specific reporting requirements for crypto trades, staking rewards, or airdrops. Keeping track of fees and understanding your tax obligations ensures your profit calculations are realistic and compliant with the law.

“Accurate profit calculation isn’t just about numbers, it’s about staying compliant with tax laws and making smarter investment choices.”

Step-by-Step Guide to Calculate Your Crypto Profit

Calculating your crypto profit may seem overwhelming at first, but breaking it down into clear steps makes the process manageable and accurate.

Step 1: Gather All Transaction Data

The first step is to collect every transaction you’ve made involving cryptocurrency. This includes purchases, sales, trades, transfers, staking rewards, and airdrops.

- Wallets, Exchanges, and Transaction History: Check all wallets and exchanges (e.g UPay, UEEx, etc) where you hold or have traded crypto. Download or export your transaction history for each platform to ensure no activity is missed.

- Using Tools to Track Transactions Automatically: To simplify data gathering, consider using portfolio tracking apps or crypto tax software (e.g TokenTax, CoinMarketCap etc) that automatically sync with your wallets and exchanges, consolidating your transaction data in one place.

Step 2: Calculate Your Total Cost Basis

Your total cost basis is the sum of all amounts spent to acquire your cryptocurrency, including purchase price and any related fees (exchange fees, network fees, commissions).

- Add the purchase prices of all your crypto acquisitions.

- Include fees paid during purchases or transfers that increase your investment cost.

Accurate cost basis calculation ensures your profit or loss reflects the true amount you invested.

Step 3: Calculate Your Total Revenue

Your total revenue is the amount you received when selling or exchanging your cryptocurrency, minus any fees associated with those transactions.

- Sum up all proceeds from sales or trades.

- Subtract any transaction fees paid during these sales.

This step reflects how much money you actually received from selling your crypto assets.

Step 4: Determine Your Net Profit or Loss

Finally, calculate your net profit or loss using the simple formula:

Profit = Total Revenue – Total Cost Basis

- If the result is positive, you made a profit.

- If negative, you incurred a loss.

This calculation clearly shows your financial outcome from crypto investments, which is essential for tax reporting and investment analysis.

Methods to Calculate Your Crypto Profit

Several approaches are available for calculating your crypto profit, ranging from manual methods to automated tools designed to handle complex transactions.

Manual Calculation Using Spreadsheets

You may want to start with spreadsheets to track buys, sells, fees, and calculate profit manually. This method allows customization but requires careful record-keeping and basic math skills. You’ll need to input all transaction details and use formulas to compute cost basis, revenue, and net profit. Spreadsheets are best for investors with a smaller number of transactions.

Using Crypto Portfolio Trackers

Crypto portfolio trackers are apps or platforms that sync with your wallets and exchanges to track your holdings and calculate profits in real time automatically. These tools offer user-friendly dashboards, charts, and alerts, helping you monitor gains without manual input.

Examples include CoinLedger and CoinMarketCap. Popular trackers often support multiple currencies and can provide profit breakdowns by asset or timeframe.

Utilizing Crypto Tax Software

Crypto tax software is specialized for calculating taxable gains and generating tax reports based on your transaction history. These platforms handle complex scenarios like different accounting methods, multiple trades, forks, airdrops, and staking rewards.

Some crypto activities require special consideration when calculating profit, as they don’t follow simple buy-sell patterns.

Examples include TokenTax and Koinly. They are especially useful for active traders and those who want to ensure compliance with tax regulations.

“In crypto, a small oversight like forgetting to include a transaction fee can significantly skew your profit calculation.”

Handling Complex Scenarios

For instance, if you buy and sell the same cryptocurrency multiple times at different prices, you need to determine which cost basis method to apply (e.g., FIFO—First In, First Out; LIFO—Last In, First Out) to accurately calculate profit for each sale.

Crypto forks and airdrops result in receiving new tokens without a direct purchase. The fair market value of these tokens at the time you receive them usually becomes your cost basis, and tracking this is essential to calculate profit when you sell these assets.

Staking rewards and locked crypto earnings are often treated as income. The value of these rewards when received forms their cost basis, and profit is calculated when you later sell the tokens.

When you trade one cryptocurrency for another (crypto-to-crypto swap), it is treated as a taxable event in many jurisdictions. You must calculate the fair market value of the crypto you gave up and the value of the crypto you received to determine your profit or loss from the trade.

Tips to Maximize Accuracy in Your Calculations

Accurate calculation of your crypto profit relies heavily on thorough record-keeping and consistent methods. Here are key tips to help you maximize accuracy:

Keeping Detailed Records

Maintain comprehensive records of every crypto transaction, including purchases, sales, transfers, staking rewards, airdrops, and fees. Detailed records make it easier to verify data, resolve discrepancies, and support your calculations during tax season or audits.

Regularly Updating Your Portfolio

Frequently update your portfolio and transaction logs to reflect the latest trades and holdings. Real-time tracking reduces errors from missing or forgotten transactions and helps you respond quickly to market changes.

Accounting for All Fees and Costs

Include every fee, exchange fees, network (miner) fees, withdrawal fees, and commissions, in your cost basis and revenue calculations. Overlooking fees can lead to overstated profits and potential tax issues.

Using Consistent Accounting Methods

Choose and stick with a consistent accounting method for handling multiple trades of the same cryptocurrency. Whether you use FIFO (First In, First Out), LIFO (Last In, First Out), or another method, consistency ensures your profit calculations remain reliable and compliant with tax guidelines.

Common Mistakes to Avoid When Calculating Crypto Profit

Avoiding these frequent errors will help ensure your crypto profit calculations are accurate and reliable.

Ignoring Transaction Fees

Many investors overlook the impact of fees charged by exchanges and blockchain networks. Failing to include these fees in your cost basis or revenue reduces the accuracy of your profit calculation, often making your gains appear larger than they actually are.

Forgetting Tax Implications

Not accounting for tax obligations or misunderstanding tax rules related to crypto profits can lead to costly mistakes, such as underreporting income or missing important taxable events like crypto-to-crypto trades, staking rewards, or forks.

Mixing Up Cost Basis Methods

Switching between accounting methods (e.g., FIFO vs. LIFO) without consistency can cause confusion and inaccuracies in profit calculation. It can also raise red flags with tax authorities if your reporting isn’t consistent across tax periods.

Not Considering Transfers Between Wallets

Transferring cryptocurrency between your own wallets or accounts is not a taxable event, but if you fail to track these transfers properly, you might accidentally count them as sales or purchases, distorting your profit and loss statements. Properly labeling and recording transfers prevents double-counting and errors.

“Whether you’re HODLing or trading daily, knowing how to calculate your gains empowers you to own your financial journey with confidence.”

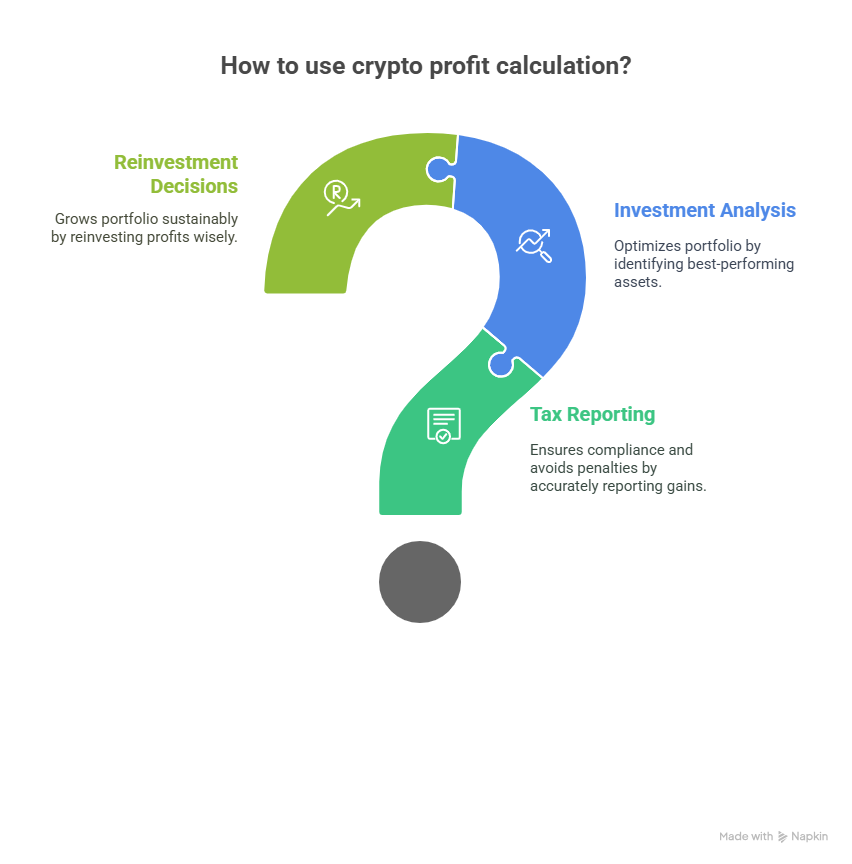

How to Use Your Crypto Profit Calculation

For Tax Reporting and Compliance

Accurate profit calculations are essential for meeting tax obligations. Use your profit data to fill out tax forms correctly, report capital gains or income from crypto activities, and avoid penalties. Staying compliant with local tax laws ensures peace of mind and helps you plan for future tax liabilities.

For Investment Analysis and Strategy Adjustment

Analyzing your profit trends helps identify which investments and strategies are working best. Knowing which assets yield the highest returns or where losses occur, you can adjust your portfolio to maximize gains, minimize risks, and optimize your overall investment approach.

For Reinvestment Decisions

Knowing your net profit enables smarter reinvestment decisions. You can decide how much profit to cash out, reinvest, or diversify into new cryptocurrencies or other assets. Using your profit calculations this way helps grow your portfolio sustainably while managing risk effectively.

Tools and Resources for Calculating Your Crypto Profit

Leveraging the right tools can simplify profit calculations and help you stay organized and compliant.

Top Crypto Portfolio Trackers

- CoinTracking: Offers real-time portfolio tracking and profit/loss analysis with extensive exchange integrations.

- Blockfolio (FTX App): User-friendly mobile tracker with price alerts and portfolio management.

- Delta: Supports multiple exchanges and wallets, providing detailed profit reports and market insights.

Top Crypto Tax Software

- CoinTracker: Automated tax reporting with support for various accounting methods and tax jurisdictions.

- Koinly: Handles complex scenarios like staking, airdrops, and crypto-to-crypto trades with easy tax form generation.

- CryptoTrader.Tax: Simplifies importing transactions and generating IRS-compliant tax reports for cryptocurrency investors.

These tools can help you save time, improve accuracy, and give clearer insights into your crypto profits.

Conclusion

Calculating your crypto profit is an important step in managing your cryptocurrency investments effectively. Your grasp of key concepts like cost basis, realized versus unrealized gains, and accounting for fees and taxes can help you to accurately track your financial outcomes.

Regardless of how you choose to calculate your crypto profits, whether manually or through specialized portfolio trackers and tax software, maintaining detailed records and consistent accounting methods ensures precision and compliance.

With accurate profit calculations, you can confidently handle tax reporting, analyze your investment strategies, and make informed decisions about reinvestment.

Frequently Asked Questions (FAQs)

What is the difference between realized and unrealized profit?

Realized profit refers to the gains or losses you have locked in by selling or trading your cryptocurrency. Unrealized profit (also called paper profit) is the potential gain or loss on crypto assets you still hold and haven’t sold yet.

How do transaction fees affect my crypto profit?

Transaction fees reduce your overall profit because they increase your cost basis when buying or reduce your revenue when selling. Including all fees ensures your profit calculation reflects the true net gain.

Can I calculate profit on crypto-to-crypto trades?

Yes. Crypto-to-crypto trades are taxable events in many jurisdictions. You calculate profit by determining the fair market value of the crypto you gave up and received at the time of the trade.

What is the best method to calculate crypto profit for taxes?

Common methods include FIFO (First In, First Out), LIFO (Last In, First Out), and Specific Identification. The best method depends on your country’s tax laws and your trading style, but consistency in method use is key.

How do I track profits from staking and yield farming?

Staking rewards and yield farming income are usually treated as taxable income at the time you receive them. Track the fair market value of rewards when received, and calculate profit or loss when you eventually sell those tokens.

Are there free tools to calculate crypto profit?

Yes. Some portfolio trackers like Blockfolio and Delta offer free profit tracking features. Additionally, there are free spreadsheet templates available for manual calculation.

How often should I calculate my crypto profit?

It’s best to update your profit calculations regularly, monthly or quarterly, especially if you trade frequently. Regular updates help maintain accurate records and simplify tax reporting.

How do forks and airdrops affect profit calculations?

Forks and airdrops give you new tokens without purchase. The fair market value of these tokens at receipt becomes your cost basis. When you sell these tokens later, you calculate profit based on this cost basis.